Accounting for property damage settlements. Reimbursement of expenses under a student agreement 209 83,000 calculations for other income

" № 9/2016

An autonomous healthcare institution (dental clinic) entered into a student training agreement with its employee and paid through services to the educational institution under subarticle 226 “Other work, services” of KOSGU. After studying, the employee quit, but agreed to reimburse the cost of training. How to account for the return of funds by a former employee through the institution's cash desk?

Employer based on the provisions Art. 198 Labor Code of the Russian Federation has the right to conclude a student agreement with the employee to receive education without interruption or without interruption from work. A student agreement with an employee is additional to the employment contract.

By virtue of Art. 199 Labor Code of the Russian Federation The apprenticeship contract must also contain the employee’s obligation to undergo training and, in accordance with the acquired profession, specialty, qualification, to work under an employment contract with the employer for the period established in the apprenticeship agreement. In case of non-fulfillment of the duty to work for an unexcused reason, the employee is obliged to reimburse the employer for expenses (expenses) associated with training ( Art. 207, 249 Labor Code of the Russian Federation). The list of expenses associated with paying for employee training is not specified in the Labor Code of the Russian Federation.

At the same time, the following should be noted. Based on the norms of the Labor Code of the Russian Federation, Federal Law No. 323-FZ ensuring advanced training of specialists (doctors, nurses, pharmacists, pharmacists) working in medical institutions, as well as their acquisition of additional specialization to perform a new type of medical activity on the instructions of the employer in this institution is the responsibility of the employer - a medical organization. They are carried out at his expense, since they are recognized as a necessary condition for the implementation of medical activities.

Please note that the terms of the agreement on sending to advanced training courses, the implementation of which is the responsibility of the employer, with the imposition on the employee of the obligation to reimburse the costs associated with training, are not subject to application by force of law. This conclusion is confirmed by arbitration practice (see the appeal rulings of the Supreme Court of the Republic of Bashkortostan dated January 21, 2016 in case No. 33-1063/2016, the Astrakhan Regional Court dated November 11, 2015 in case No. 33-3952/2015). In other words, the employer (medical institution) cannot recover from the employee the costs of his training or retraining, since he is obliged to improve his qualifications.

Since the question asked does not specify the category of specialist, we will provide accounting records for the return of funds spent by the employer on employee training.

The costs of paying for employee training services are included in the autonomous institution according to expense type code 244“Other procurement of goods, works and services to meet state (municipal) needs” linked by subarticle 226“Other works, services” KOSGU ( Instructions No. 65n).

The expenses of an autonomous institution for professional training of an employee in this case are reflected in the accounting entry ( clause 61 of Instruction No. 183n):

Account debit 0 109 80 226“General business expenses in terms of other works and services”

Account credit 0 302 26 730“Calculations for other works, services”

The amount of money to be reimbursed by the employee is recognized as income of the institution and is attributed to article 130“Income from the provision of paid services (work)” KOSGU (Instructions No. 65n).

The accrual of this income is made using accounts 209 30 000 (clause 220 of Instruction No. 157n, clause 112 of Instruction No. 183n).

In accounting, transactions for employee reimbursement of expenses related to tuition fees will be reflected as follows ( clause 112 of Instruction No. 183n):

Account debit 0 209 30 000"Calculations for cost compensation"

Account credit 0 401 10 130“Income from the provision of paid services”

The employee’s deposit of cash into the institution’s cash desk is reflected by the posting ( clause 113 of Instruction No. 183n):

Account debit 0 201 34 000"Cash register"

Account credit 0 209 30 000"Calculations for cost compensation"

Federal Law of November 21, 2011 No. 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation.”

Instructions on the procedure for applying the budget classification of the Russian Federation, approved. By Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.

Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

Return back to

The shortage of inventories in accordance with clause 220 of the Instructions to the Unified Chart of Accounts No. 157n, clause 109 of Instructions No. 174n should be reflected using account 209 74 000 “Calculations for damage to inventories”.

If a shortage is identified, the amount of damage caused must be established.

In this case, one must proceed from the current replacement cost of material assets (that is, the amount necessary to restore them) on the day the damage was discovered.

Budgetary institutions reflect damage from a shortage of movable property on account 209.00 “Calculations for damage to property and other income” under KFO 2 “Income-generating activities”.

This also reflects the damage from the shortage of property that was acquired using subsidies and was listed under KFO 4.

In this case, proceeds from the perpetrators for damages are the institution’s own income.

The institution is not obliged to transfer these funds to the budget. This is due to the fact that funds from the sale of movable property of budgetary institutions are not included in budget income (paragraph 3, paragraph 3, article 41 of the Budget Code of the Russian Federation).

The accounting should reflect: accrual of debt for shortages of non-financial assets (at current replacement cost) in terms of material inventories:

Debit 2.209.74.560 credit 2.401.10.172.

Write-off of inventories:

Debit 4.401.10.172 credit 4.105.32.440 - write-off of food products;

Debit 2.401.10.172 credit 2.105.31.440 - write-off of medications.

Receipt of funds to the cash desk to compensate for damages from shortages:

Debit 2.201.34.510 credit 2.209.74.660.

Cash for shortages of products deposited into the current account cannot be attributed to the restoration of cash expenses for the subsidy.

When maintaining accounting records, it is necessary to draw a clear line between “income” transactions and operations to restore cash payments.

“Restoration of cash payments,” as a rule, refers to the receipt of funds aimed at restoring specific cash expenses of a government agency - funds must come from the legal (individual) person (counterparty) to whom such payment was made earlier, and within the framework of the same agreement (within the same operation).

![]()

O. Grishakova

expert of the journal “Institutions of physical culture and sports: accounting and taxation”

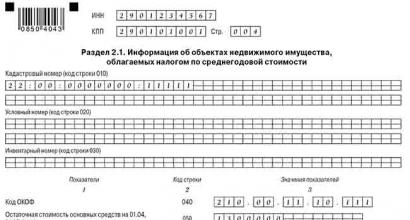

By Order of the Ministry of Finance of the Russian Federation dated December 27, 2017 No. 255n (hereinafter referred to as Order No. 255n), new codes were introduced into the classification of operations of the general government sector. They should be applied from the beginning of 2018. In this regard, it is necessary to introduce new analytical accounting accounts into the working chart of accounts that correspond to the newly introduced KOSGU codes. In the article we will consider the procedure for accounting for calculations of income of budgetary and autonomous sports institutions based on Order No. 255n and draft amendments to instructions No. 174n, 183n (posted on the website www.regulation.gov.ru).

In the accounting of state (municipal) institutions, the following synthetic accounts are used for income calculations:

– 0 205 00 000 “Calculations for income” - it reflects the amounts of income (receipts) accrued by the institution at the time of the appearance of claims against their payers arising by virtue of contracts, agreements (including the amount of advance payment received from payers), as well as when the institution performs the functions assigned to it in accordance with the legislation of the Russian Federation;

– 0 209 00 000 “Calculations for damage and other income” - it is intended to record calculations for the amounts of identified shortages, thefts, damage to funds and other valuables, other amounts of damage caused to the property of the institution, subject to compensation by the guilty parties in the manner established by the legislation of the Russian Federation, for amounts of advance payment not returned by the counterparty in the event of termination of contracts (other agreements), including by court decision, for amounts of debt of accountable persons not returned in a timely manner (not withheld from wages), for amounts of debt for unworked vacation days upon dismissal employee until the end of the working year for which he has already received annual paid leave, for the amounts of excess payments made, for the amounts of forced withdrawal, including compensation for damage in accordance with the legislation of the Russian Federation, in the event of insured events, for the amount of damage caused due to the actions (inaction) of officials of the organization, as well as the amount of compensation for expenses incurred by institutions in connection with the implementation of the requirements established by the legislation of the Russian Federation.

Accounting for income settlements on account 205 00 000

Before Order No. 255n came into effect, the synthetic account 0 205 00 000 included the following analytical accounts:

– 0 205 20 000 “Calculations for income from property” (code 120 KOSGU);

– 0 205 30 000 “Calculations for income from the provision of paid work and services” (code 130 KOSGU);

– 0 205 40 000 “Calculations for forced seizure amounts” (code 140 KOSGU);

– 0 205 50 000 “Calculations for revenues from budgets” (according to the corresponding analytical accounts) (code 150 KOSGU);

– 0 205 70 000 “Calculations for income from operations with assets” (according to the corresponding analytical accounts) (code 170 KOSGU);

– 0 205 80 000 “Calculations for other income” (code 180 KOSGU).

With the entry into force of Order No. 255n, codes 120, 130, 140, 180 KOSGU became grouped and now include a number of new subarticles of KOSGU.

|

Account number and name (taking into account draft orders of the Ministry of Finance on amendments to instructions No. 174n, 183n) |

|

|

Property income |

|

|

121 “Income from operating leases” |

0 205 21 000 “Settlements with payers of income from operating leases” |

|

122 “Income from finance leases” |

0 205 22 000 “Calculations for income from finance leases” |

|

124 “Interest on deposits, cash balances” |

0205 24 000 “Calculations for income from interest on deposits, cash balances” |

|

129 “Other income from property” |

0205 29 000 “Calculations for other income from property” |

|

Income from the provision of paid services (work), compensation of costs |

|

|

131 “Income from the provision of paid services (work)” |

0 205 31 000 “Settlements with payers for income from the provision of paid services (work)” |

|

135 “Income from conditional rental payments” |

0 205 35 000 “Calculations for conditional lease payments” |

|

Other income |

|

|

183 “Income from subsidies for other purposes” |

0 205 83 000 “Calculations for subsidies for other purposes” |

|

184 “Income from subsidies for capital investments” |

0 205 84 000 “Calculations for subsidies for capital investments” |

|

189 “Other income” |

0 205 89 000 “Calculations for other income” |

To account 0 205 00 000 in the structure of the working chart of accounts (in the 15th – 17th digits of the account), the corresponding codes of the income subtype are applied according to subsection. 4.1 classification of budget revenues.

The most common operations for accrual and receipt of income in budgetary and autonomous sports institutions are shown in the table.

|

Income accrued in the amount of the subsidy provided for the implementation of the state (municipal) task |

4 205 31 560 (000) |

|

|

Deferred income has been accrued in the form of subsidies for the implementation of state (municipal) tasks under agreements on the provision of subsidies (grants) in the next financial year (years following the reporting year) |

4 205 31 560 (000) |

|

|

Income was accrued for the subsidy provided to the institution for other purposes in the amount of expenses confirmed by the report (basis - accounting certificate (f. 0504833)) |

5 205 83 560 (000) |

|

|

Income accrued on budget investments provided in the manner established by the legislation of the Russian Federation in the amount confirmed by the report |

6 205 84 560 (000) |

|

|

Accrued income from operating lease of property transferred to tenants in accordance with concluded agreements |

2 205 21 560 (000) |

|

|

Income accrued for work performed, services provided, goods sold (within the types of income-generating activities of the institution provided for by the statutory documents) |

2 205 31 560 (000) |

|

|

Accrued to customers (in accordance with long-term contracts) amounts of future income for individual stages of finished products, works, services completed and delivered to them |

2 205 31 560 (000) |

|

|

Accrued income from contingent rental payments |

0 205 35 560 (000) |

|

|

Other income has been accrued, including received donations (grants), charitable (gratuitous) transfers |

2 205 89 560 (000) 2 205 52 560 (000) 2 205 53 560 (000) |

|

|

The receipt of income under the concluded contracts (agreements) is reflected |

0 201 11 510 (000) 0 201 21 510 (000) 0 201 34 510 (000) |

0 205 00 660 (000) |

|

A decrease in settlements with debtors for income is reflected by the termination of a counterclaim by offset |

2 205 00 660 (000) |

|

|

Income receivables, recognized in accordance with the legislation of the Russian Federation as unrealistic for collection (not claimed by income creditors), were written off from the balance sheet. |

Off-balance sheet account 04 |

0 205 00 660 (000) |

Thus, income received in the form of a subsidy for the implementation of a state (municipal) task and from the provision of paid services (works) provided for by the institution’s charter is accounted for in one account under code 131 KOSGU (previously - under code 130 KOSGU); Income received under operating leases is reflected under code 121 KOSGU (previously - under code 120 KOSGU). Accounting for other types of income is now more detailed. Thus, income related to compensation of institution expenses under a lease agreement is classified as contingent rental payments and is accounted for separately.

It should be noted that transactions of autonomous and budgetary institutions for VAT and corporate income tax are now reflected in the corresponding subarticle of KOSGU (131 “Income from the provision of paid services (work)” or 189 “Other income”) in accordance with the decision of the institution adopted within the framework of its accounting policies.

The autonomous sports institution rented out an ice skating rink for the period of the Olympics from March 1 to March 11. The lease agreement separately provides for a fixed rent of 55,000 rubles. and reimbursement by the tenant of electricity costs based on actual meter readings. At the end of this event, the last expenses amounted to 2,700 rubles.

In order to simplify the example, operations on the internal movement of leased property and the calculation of income tax are not given.

According to the GHS “Lease”, this accounting object relates to operating lease.

Accounting records, based on acts of services rendered, reflect settlements with the tenant for rent and contingent rental payments.

|

Amount, rub. |

|||

|

The transfer of the ice rink to the tenant is reflected |

Off-balance sheet account 25 |

||

|

Accrued future income from operating leases (at the time of conclusion of the lease agreement) |

|||

|

Recognition of income for the current financial year is reflected (based on the act of provision of services) |

|||

|

Conditional lease payments have been accrued (based on the act of actual electricity costs) |

|||

|

Cash received from the tenant to the personal account in the form of a rental payment |

Off-balance sheet account 17 |

||

|

Funds received from the tenant to the personal account in the form of a conditional rental payment |

Off-balance sheet account 17 |

||

|

The transfer of the ice skating rink to the institution is reflected |

Off-balance sheet account 25 |

*

In conditional valuation.

Accounting for certain types of settlements on account 209 00 000

This synthetic account is used to generate information in monetary terms about the status of settlements for the amounts of damage caused to a budgetary or autonomous institution, other income and contains the following groups of accounts:

– 0 209 30 000 “Calculations for cost compensation”;

– 0 209 40 000 “Calculations for fines, penalties, penalties, damages”;

– 0 209 70 000 “Calculations for damage to non-financial assets”;

– 0 209 80 000 “Calculations for other income.”

Before Order No. 255n came into force, analytical accounts were applied only to accounts 0 209 70 000, 0 209 80 000. Now it is necessary to use new analytics to accounts 0 209 30 000, 0 209 40 000.

Let us present in the table the new KOSGU codes and the corresponding analytical accounts used in calculating damage and other income in the activities of budgetary and autonomous sports institutions.

|

KOSGU code (as amended by Order No. 255n) |

Account number and name (taking into account draft orders of the Ministry of Finance on amendments to instructions 174n, 183n) |

|

Income from reimbursement of expenses |

|

|

134 “Income from compensation of costs” |

0 209 34 000 “Calculations for cost compensation” |

|

Fines, penalties, penalties, damages |

|

|

141 “Income from penalties for violation of procurement laws” |

0 209 41 000 “Calculations of income from penalties for violation of procurement legislation and violation of the terms of contracts (agreements)” |

|

143 “Insurance compensation” |

0 209 43 000 “Calculations for income from insurance claims” |

|

144 “Compensation for property damage (except for insurance compensation)” |

0 209 44 000 “Calculations for income from compensation for property damage (except for insurance compensation)” |

|

145 “Other income from forced seizure amounts” |

0 209 45 000 “Calculations for income from other amounts of forced seizure” |

|

Other income |

|

|

189 “Other income” |

0 209 89 000 “Calculations for other income”* |

*

Previously, account 0 209 83 000 was used to account for other income.

In the structure of the working chart of accounts, the corresponding income subtype codes are applied to account 0 209 00 000 (in the 15th – 17th digits of the account) in accordance with subsection. 4.1 classification of budget revenues.

|

Income accrual transactions |

||

|

The amount of the employee's debt for the amount of wages overpaid to him (not withheld from wages) is reflected in the event that the employee disputes the grounds and amounts of deductions |

0 209 34 560 (000) |

|

|

The amount of debt of the former employee to the institution for unworked vacation days was accrued when he was dismissed before the end of the working year for which he had already received annual paid leave |

0 209 34 560 (000) |

|

|

Reflects the amount of debt to the institution, subject to compensation by court decision, in the form of compensation for expenses associated with legal proceedings (payment of state fees, legal costs) |

0 209 34 560 (000) |

|

|

An amount of damage has been accrued in the form of interest for the use of someone else's money due to their unlawful retention, evasion of their return, other delay in their payment or unjustified receipt or savings |

0 209 45 560 (000) |

|

|

The amount of debt for compensation for property damage is reflected in accordance with the legislation of the Russian Federation in the event of insured events |

0 209 43 560 (000) |

|

|

Reflects the debt for fines, penalties, penalties accrued for violation of the terms of contracts for the supply of goods, performance of work, provision of services, and other sanctions |

2 209 41 560 (000) |

|

|

A debt has been accrued in the amount of claims for compensation of costs to recipients of advance payments (accountable amounts) for advance payment made under contracts (agreements), as well as on other grounds in accordance with the legislation of the Russian Federation, not returned by the counterparty in the event of termination of the contract (agreement), including based on the results of claims work (court decision) |

0 209 34 560 (000) |

0 206 00 660 (000) 0 208 00 660 (000) |

|

The amount of debt for compensation of expenses incurred by the institution in connection with the implementation of the requirements established by the legislation of the Russian Federation is reflected |

0 209 34 560 (000) |

|

|

Operations for receipt, offset and write-off of income |

||

|

Funds were received from the perpetrators to compensate for the damage caused to the institution, as well as for other income |

0 201 11 510 (000) 0 201 21 510 (000) 0 201 34 510 (000) |

0 209 00 660 (000) |

|

The guilty person was compensated for damages from wages (other payments) in the amount of deductions made in the manner prescribed by the legislation of the Russian Federation |

0 304 03 830 (000) |

0 209 00 660 (000) |

|

The amount of damage was written off from the balance sheet due to the failure to identify the perpetrators (with its clarification by court decisions) |

0 209 00 660 (000) |

|

|

The amount of damage was written off from the balance sheet in connection with the suspension, in accordance with the legislation of the Russian Federation, of a preliminary investigation, criminal case or forced recovery, as well as in connection with the recognition of the guilty person as insolvent |

Off-balance sheet account 04 |

0 209 00 660 (000) |

|

Settlements with debtors for income have been reduced by terminating the counterclaim by offset when making a decision to withhold the amount of accrued penalties by paying the executor of the agreement (contract) an amount reduced by the amount of the penalty (penalties, fines): |

||

|

in terms of obligations under the agreement (contract) assumed through income-generating activities |

2 302 00 830 (000) |

2 209 41 660 (000) |

|

in terms of obligations under the agreement (contract) accepted at the expense of other sources of financial support |

2 304 06 830 (000) |

2 209 41 660 (000) |

In a budgetary sports institution, an employee who has entered into an employment contract for the first time is given a work book form for a fee (in the amount of the cost of purchasing it). The cost of the work book form is deducted from the employee’s salary at his request. Salaries are paid through subsidies for the implementation of government tasks.

The accounting policy of the institution provides for the calculation of VAT and corporate income tax according to code 131 KOSGU.

When issuing a work book or an insert to it to an employee, the employer charges the employee a fee, the amount of which is determined based on the costs of their acquisition (clauses 46 - 47 of the Rules for maintaining and storing work books, producing work book forms and providing them to employers, approved by Decree of the Government of the Russian Federation dated April 16, 2003 No. 225).

The payment collected by the employer when issuing a work book or an insert to it to an employee is subject to accounting when determining the base for corporate income tax and VAT (Letter of the Federal Tax Service of the Russian Federation dated June 23, 2015 No. GD-4-3/10833@).

In the accounting records of a budgetary institution, these transactions are reflected as follows:

|

The debt owed to the employee is reflected in the amount of compensation for the cost of the work book form |

||

|

VAT charged |

||

|

Corporate income tax accrued |

||

|

The amount of compensation for the cost of the work book form is withheld from the employee’s salary |

||

|

The transfer of the withholding amount from KVFO 4 to KVFO 2 to pay off the debt is reflected |

||

|

The employee’s debt for compensation of expenses for the purchase of a work book form has been repaid |

An autonomous sports institution entered into an agreement for the supply of sports equipment in the amount of 500,000 rubles. Payment under the agreement is made from targeted subsidies. The supply of inventory was made in violation of the deadline stipulated by the contract. In this regard, the supplier was required to pay a penalty in the amount of 25,000 rubles.

In accounting, these transactions are reflected as follows:

The car of a budgetary sports institution was damaged as a result of an accident. The institution is recognized as the injured party. In accordance with the contract of compulsory motor third party liability insurance (MTPL) for vehicles, the insurer transferred the insurance compensation to the personal account of the institution.

The accounting policy of the institution provides for reflecting the accrual and payment of corporate income tax under code 131 KOSGU.

The amount of insurance compensation is subject to accounting for the purposes of calculating corporate income tax as part of non-operating income on the basis of Art. 250 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated November 10, 2017 No. 03-03-06/3/74209).

The accounting records of a budgetary institution reflect the following transactions:

In conclusion, let's summarize the above. With the entry into force of Order No. 255n, the income of budgetary and autonomous institutions is detailed with new KOSGU codes. According to these changes in the working chart of accounts, it is necessary to provide new analytical accounts for accounts 0 205 00 000, 0 209 00 000. Moreover, these changes must be applied from the beginning of 2018. In the article, we presented new KOSGU codes for income, the corresponding analytical accounting accounts used in budgetary and autonomous institutions, and also, using examples, we examined the procedure for accounting for individual income transactions based on prepared draft orders of the Ministry of Finance on amendments to instructions

No. 174n, 183n.

Approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.

According to Order of the Ministry of Finance of the Russian Federation dated February 20, 2018 No. 29n.

Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

Approved by Order of the Ministry of Finance of the Russian Federation No. 65n.

Federal accounting standard for public sector organizations “Rent”, approved. By Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 258n.

Calculations for damage and other income

Source: Magazine "Cultural and artistic institutions: accounting and taxation"

In the economic activities of institutions, there are sometimes cases of theft, shortages and other damage. In accordance with Instruction No. 157n, they are subject to reflection on account 209 00 “Calculations for damage and other income.” By Order of the Ministry of Finance of the Russian Federation dated August 29, 2014 No. 89n, changes were made to this instruction, which also affected the specified account. In the article we will consider which facts of the economic life of state (municipal) institutions and in what order should be reflected using this account.

General procedure for accounting for damage

Due to the adopted changes to Instruction No. 157n score 209 00 “Calculations for damage and other income” began to have wider application. So, in addition to recording on it calculations for the amounts of identified shortages, thefts of other valuables, for the amounts of losses from damage to material assets, other amounts of damage caused to the property of the institution, subject to compensation by the guilty parties in accordance with the legislation of the Russian Federation, calculations are subject to accounting on this account ( paragraph 220 Instructions No.157n):

- for amounts of advance payments not returned by the counterparty in the event of termination of contracts (other agreements), including by court decision;

- on amounts of debt of accountable persons that were not returned in a timely manner (not withheld from wages);

- on the amount of debt for unworked vacation days upon dismissal of an employee before the end of the working year for which he has already received annual paid leave;

- on the amounts of excessive payments made;

- on the amounts of forced seizure, including compensation for damage in accordance with the legislation of the Russian Federation, if cases arise;

- for the amount of damage caused as a result of the actions (inaction) of officials of the organization.

Previously, when determining the amount of damage caused by shortages and thefts, they proceeded from market the value of material assets on the day the damage was discovered. Market value was understood as the amount of money that could be received as a result of the sale of these assets.

Now the current value is used to determine the amount of damage restorative cost, which refers to the amount of money required to restore lost assets.

Facts of identified shortages, thefts and other damage can be immediately attributed to the perpetrators if they are identified and recognized. For the amounts of damage not recognized by the guilty parties for compensation, materials drawn up in the prescribed manner are transferred for filing a civil claim or initiating a criminal case in the prescribed manner. The amounts of damage claimed for compensation are specified in accordance with a court decision, writ of execution, or on other grounds in accordance with the legislation of the Russian Federation.

In all cases, identified shortages and damage are confirmed by inventory results ( clause 1.5 of the Guidelines for inventory of property and liabilities, approved By Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 ).

TO account 209 00 analytical groups of the synthetic account of the accounting object are opened:

- 30 “Calculations for cost compensation”;

- 40 “Calculations on forced seizure amounts”;

- 70 “Calculations for damage to non-financial assets”;

- 80 “Calculations for other income.”

Let's consider what calculations are reflected in each of them. To do this, we will also use the draft changes in instructions no.162n, 174n And 183n, which are posted on the website of the Ministry of Finance.

On account 209 30 000 “Calculations for cost compensation” are reflected:

- the amount of damage for advance payments made within the framework of state (municipal) contracts for the needs of the institution, other agreements not returned by the counterparty in the event of termination of contracts (other agreements), including by a court decision, in the conduct of claims work;

- the amount of damage for the debt of accountable persons that was not returned in a timely manner (not withheld from wages), including in the case of challenging the deductions;

- the amount of damage in the form of debt of former employees to the institution for unworked vacation days upon their dismissal before the end of the working year for which he had already received annual paid leave;

- the amount of damage subject to compensation by a court decision in the form of compensation for expenses associated with legal proceedings (payment of state fees, payment of legal costs).

On account 209 40 000 “Calculations for forced seizure amounts” should reflect:

- the amount of damage in the form of accrued interest for the use of someone else's money as a result of their unlawful retention, evasion of their return, other delay in their payment or unjust receipt or savings;

- the amount of expenses associated with legal proceedings.

Calculations for damage to property of state (municipal) institutions are reflected in the accounts:

- 209 71 000 “Calculations for damage to fixed assets”;

- 209 72 000 “Calculations for damage to intangible assets”;

- 209 73 000 “Calculations for damage to non-produced assets”;

- 209 74 000 “Calculations for damage to inventories.”

Calculations for other damage to other property of institutions are reflected in the accounts:

- 209 81 000 “Calculations for cash shortages”;

- 209 82 000 “Calculations for shortages of other financial assets”;

- 209 83 000 “Calculations for other income.”

It should be clarified that account 209 83 000 calculations for other income arising in the course of the institution’s economic activities that are not reflected in the accounts calculations 205 00 "Calculations based on income."

According to paragraph 222 Instructions No.157n analytical accounting for account 209 00 is kept in the card for recording funds and settlements (f. 0504051) in the context of persons for compensation for damage caused (perpetrators), type of property, and (or) amounts of damage, including for identified thefts and shortages.

To reflect the damage, the following invoice correspondences are proposed:

|

State institution (Instruction No. 162n) |

State-financed organization (Instruction No. 174n) |

Autonomous institution (Instruction No. 183n) |

|||

|

Accrual of debt for damage in terms of compensation of costs |

|||||

|

1 209 30 560 |

1 401 10 130 |

0 209 30 560 |

0 401 10 130 |

0 209 30 000 |

0 401 10 130 |

|

Accrual of debt for damage in terms of amounts of forced seizure |

|||||

|

1 209 40 560 |

1 401 10 140 |

0 209 40 560 |

0 401 10 140 |

0 209 40 000 |

0 401 10 140 |

|

Accrual of debt for shortages (thefts) of fixed assets |

|||||

|

1 209 71 560 |

1 401 10 172 |

0 209 71 560 |

0 401 10 172 |

0 209 71 000 |

0 401 10 172 |

|

Accrual of debt for shortages (thefts) of intangible assets |

|||||

|

1 209 72 560 |

1 401 10 172 |

0 209 72 560 |

0 401 10 172 |

0 209 72 000 |

0 401 10 172 |

|

Accrual of debt for shortages (thefts) of non-produced assets |

|||||

|

1 209 73 560 |

1 401 10 172 |

0 209 73 560 |

0 401 10 172 |

0 209 73 000 |

0 401 10 172 |

|

Accrual of debt for shortages (thefts) of inventories |

|||||

|

1 209 74 560 |

1 401 10 172 |

0 209 74 560 |

0 401 10 172 |

0 209 74 000 |

0 401 10 172 |

|

Accrual of debt for shortages (thefts) of funds at the cash desk |

|||||

|

1 209 81 560 |

1 201 34 610 |

0 209 81 560 |

0 201 34 610 |

0 209 81 000 |

0 201 34 000 |

|

Accrual of debt for shortages (thefts) of funds from an organization’s account |

|||||

|

1 209 81 560 |

1 201 27 610 |

0 209 81 560 |

0 201 27 610 |

0 209 81 000 |

0 201 27 000 |

|

Accrual of debt for shortages (thefts) of monetary documents and other financial assets |

|||||

|

1 209 82 560 |

1 401 10 172 |

0 209 82 560 |

0 401 10 172 |

0 209 82 000 |

0 401 10 172 |

|

Accrual of debt for other income not reflected in account 205 00* |

|||||

|

1 209 83 560 |

1 401 10 180 |

0 209 83 560 |

0 401 10 180 |

0 209 83 000 |

0 401 10 180 |

|

Accrual of recovered debt of insolvent debtors for identified shortages, thefts, losses previously written off off-balance sheet |

|||||

|

1 209 30 560 1 209 40 560 1 209 70 560 1 209 80 560 |

1 401 10 173 |

0 209 30 560 0 209 40 560 0 209 70 560 0 209 80 560 |

0 401 10 173 |

0 209 30 000 0 209 40 000 0 209 70 000 0 209 80 000 |

0 401 10 173 |

|

At the same time, the recovered debt is written off from the off-balance sheet account |

|||||

* At the time of writing, in the draft amendments to instructions No. 162n, 174n, 183n, posted on the website of the Ministry of Finance, correspondence with score 209 83 000 not provided.

Compensation for damage caused to an institution is reflected in accounting as follows:

|

State institution (Instruction No. 162n) |

State-financed organization (Instruction No. 174n) |

Autonomous institution (Instruction No. 183n) |

|||

|

Receipt of funds from the perpetrators for damages |

|||||

|

1 201 34 510 1 210 02 000 1 303 05 830 1 201 21 510 |

1 209 30 660 1 209 40 660 1 209 70 660 1 209 80 660 |

0 201 34 510 0 201 11 510 |

0 209 30 660 0 209 40 660 0 209 70 660 0 209 80 660 |

0 201 34 000 0 201 11 000 0 201 21 000 |

0 209 30 000 0 209 40 000 0 209 70 000 0 209 80 000 |

|

Compensation for damage by the perpetrators in kind |

|||||

|

1 401 10 172 |

1 209 70 660 1 209 82 660 |

0 401 10 172 |

0 209 70 660 0 209 82 660 |

0 401 10 172 |

0 209 70 000 0 209 82 000 |

|

Compensation for damage by the guilty person by deduction from wages (other payments) |

|||||

|

1 304 03 830 |

1 209 30 660 1 209 40 660 1 209 70 660 1 209 80 660 |

0 304 03 830 |

0 209 30 660 0 209 40 660 0 209 70 660 0 209 80 660 |

0 304 03 000 |

0 209 30 000 0 209 40 000 0 209 70 000 0 209 80 000 |

|

Write-off of debt for damage from the balance sheet due to failure to identify the perpetrators |

|||||

|

1 401 10 172 |

1 209 30 660 1 209 40 660 1 209 70 660 1 209 80 660 |

0 401 10 172 |

0 209 30 660 0 209 40 660 0 209 70 660 0 209 80 660 |

0 401 10 172 |

0 209 30 000 0 209 40 000 0 209 70 000 0 209 80 000 |

|

Write-off of debt for damage from the balance sheet in connection with the suspension of the preliminary investigation, criminal case or compulsory collection, recognition of the guilty person as insolvent |

|||||

|

1 401 10 173 |

1 209 30 660 1 209 40 660 1 209 70 660 1 209 80 660 |

0 401 10 173 |

0 209 30 660 0 209 40 660 0 209 70 660 0 209 80 660 |

0 401 10 173 |

0 209 30 000 0 209 40 000 0 209 70 000 0 209 80 000 |

|

At the same time, the debt for damage is reflected in the off-balance sheet account |

|||||

Causing damage to a cultural institution

For most cultural institutions, the safety of property is of particular importance and in some cases its loss can become an irreparable loss (loss of museum valuables, rare copies of books, etc.). But it is worth noting that property objects included in the state part of the Museum Fund of the Russian Federation, the Archive Fund of the Russian Federation or the National Library Fund are not the own property of cultural institutions ( Art. 16 Federal Law No.54‑FZ). They are assigned to state museums and other government institutions with the right of operational management.

They are not reflected in accounting, although these institutions are required to ensure:

- physical safety and security of museum objects and museum collections;

- maintaining and preserving accounting documentation related to these museum objects and museum collections;

- use of museum objects and museum collections for scientific, cultural, educational, creative and production purposes.

Let's consider how situations when damage to the property of the institution itself is reflected in financial (budget) accounting. Features of accounting will be related to whether or not the person responsible for causing the damage is identified.

In the budgetary institution House of Culture, they discovered the loss of musical equipment with a book value of 120,000 rubles. Its residual value is 60,000 rubles. It is included in the composition of a particularly valuable institution for its core activities. The person who caused the damage has not been identified at this time. The theft is under investigation and a final procedural decision has not yet been made. institutions for the receipt and disposal of non-financial assets, the replacement cost of lost property is set at 140,000 rubles.

According to the explanations given in Letter of the Ministry of Finance of the Russian Federation dated October 18, 2012 No. 02‑06‑10/4354 , income from compensation for damage is the budgetary institution’s own income and is accounted for under activity code 2 - income-generating activity (institution’s own income).

These circumstances will be reflected in the accounting of a budgetary institution as follows:

|

Amount, rub. |

|||

|

Musical equipment decommissioned |

|||

|

in the amount of accrued depreciation |

4 104 24 410 |

4 101 24 410 |

|

|

in the amount of residual value |

4 401 10 172 |

4 101 24 410 |

|

|

The amount of damage caused is reflected |

2 209 71 560 |

2 401 10 172 |

|

|

The debt for damage was written off from the balance sheet due to the failure to identify the perpetrators and was simultaneously included in off-balance sheet accounting |

2 401 10 172 |

2 209 71 660 |

|

An employee of an autonomous cultural institution submitted his resignation effective November 17, 2014. Before this, they received an advance for the first half of the month. In September, this employee was granted annual paid leave, but he did not work the entire year and part of the leave was provided to him and paid in advance. When making the final settlement with this employee, it was established that due to the payment of vacation pay in advance, he owed a debt of 5,000 rubles. It is not possible to withhold this amount from the final payment, since the advance has already been received. Wages were paid from income-generating activities. The debt was reimbursed by the former employee by depositing cash into the institution's cash desk.

These transactions can be reflected as follows:

Reflection of damage calculations in reporting

According to paragraph 56 Instructions No.33n information on debt for damage caused to property is presented as part of an explanatory note to the annual reporting in form 0503776. As part of the annual budget reporting, information on shortages and thefts of funds and material assets is presented in form 0503176 ( paragraph 152 Instructions No.191n).

The order in which indicators are reflected in these forms is identical. They present analytical data generalized for the reporting period on the volume of damage and theft of the institution’s property based on the corresponding analytical accounts accounts 0 209 00 000 “Calculations for damage and other income.”

The indicators reflected in these forms must be confirmed by the relevant accounting registers.

They provide information on the existence of debt at the beginning of the year, the establishment and reduction of damage during the year, and the balance of debt at the end of the year.

Column 3 indicates the summary data on changes in calculations for property damage.

Columns 4, 5 of form 0503776 indicate data on changes in calculations for property damage (for activities with targeted funds, activities for the provision of services (work), respectively).

Columns 4, 5 of form 0503176 indicate data on changes in calculations for property damage in the context of budgetary activities and funds received for temporary use.

In addition, the indicators in columns 4, 5 on line 010 of form 0503776 must correspond to the indicators in columns 3, 4 on line 320 of the balance sheet (form 0503730), and the indicators in columns 4, 5 on line 060 of form 0503776 must correspond to the indicators in columns 7, 8 on line 320 balance (f. 0503730) ( paragraph 73 Instructions No.33n).

The indicators reflected in columns 4, 5 on line 010 of form 0503176 must correspond to identical indicators reflected in the corresponding columns “At the beginning of the year” on line 320 of the balance sheet (form 0503130).

The indicators reflected in columns 4, 5 on line 060 of form 0503176 must correspond to identical indicators reflected in the corresponding columns “At the end of the reporting period” on line 320 of the balance sheet (form 0503130) ( paragraph 171 Instructions No.191n).

Various types of damage caused to an institution are reflected in account 209 00 “Calculations for damage and other income.” With the introduction of amendments to Instruction No. 157n, this account can be used for a wider range of operations, but the specifics of such application in Instructions No. 162n, 174n and 183n have not yet been approved. The author offers correspondence accounts from the draft instructions mentioned above, posted on the website of the Ministry of Finance. Damage calculations are subject to reflection in the annual accounting (budget) statements.

Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

Instructions for using the Chart of Accounts for Budget Accounting, approved. By Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

Federal Law of May 26, 1996 No. 54-FZ “On the Museum Fund of the Russian Federation and Museums of the Russian Federation.”

Instructions on the procedure for compiling and submitting annual, quarterly state (municipal) budgetary and autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated March 25, 2011 No. 33n.

Instructions on the procedure for compiling and submitting annual, quarterly and monthly reports on the budget system of the Russian Federation, approved. By order of the Ministry of Finance of the Russian Federation dated December 28. 2010 No. 191n.