Concept and formation of income tax registers. Basic principles of tax accounting Types of tax registers for profit tax

Proper organization of maintaining tax registers will help an entrepreneur avoid a fine from the tax office. And the examined samples of tax registers for income tax will help you draw the right conclusions.

Organizations and enterprises that are registered as taxpayers must maintain registers tax accounting according to the requirements imposed by tax authorities.

Not only income tax payers are required to maintain registers of income and expenses, because this condition is not specified in the tax code, which is the subject of disputes and confusion.

Generally accepted rules for maintaining tax registers

Maintaining a tax register is the systematization and summary of data for a tax or reporting period that is not distributed in the field of accounts accounting.

Mandatory details for a tax register are: name, date of compilation or period, measures of the operation in the form of cash or in-kind equivalent, as well as a display of the operation itself. The register is confirmed by the signature of the responsible person, which must be decrypted. Such requirements are presented in Article 313 of the Tax Code.

An accounting register can also be used as a tax register, supplementing it with the necessary information, which is also provided for in Article 313.

Registers must be maintained in both paper and electronic form.

For accountants who cannot cope with the preparation of registers, tax services have developed approximate forms of sample tax registers for income tax.

In this case, the taxpayer has the right to draw up the tax register form himself and determine the accounting procedure for connecting to accounting policy and taxation. This is stated in Article 314 of the Tax Code.

According to the requirements of the tax services, registers are filled out on the basis of primary accounting documents. Forbidden:

- Fill out registers without observing the chronological order of transactions.

- Make unreasonable withdrawals from them of information on operations.

- There is no reason to add any accounting measures.

- Keeping a register is messy.

A very important point is making amendments to an already compiled register. This documentation must be protected from unauthorized intervention. Amendments and corrections have the right to be made only by the person who is responsible for maintaining the registers; the same person is obliged to certify the amendment made with his signature and the date of the correction.

Income tax accounting

When filling out an income tax return, a minimum of 2 tax accounting registers for income tax are required. . One of them will display tax accounting of income, and the other will display expenses. Information provided on the basis of registers is necessary for the calculation tax base– profit, because without this stage the calculation of the income tax itself is impossible.

An organization will definitely need additional registers if its activities have several varieties. In this case, each type of transaction performed is entered into the contents of the register.

Transactions that are taxed in a special manner also require separate registration.

For example, the minimum list of necessary registers for calculating the income tax of Tsvetochek LLC:

- Register of tax accounting for income from sales.

- Register of tax accounting of transactions that reduce sales income.

- RNU on non-operating income.

- RNU on non-operating expenses.

When filling out income registers, it is worth remembering that the amount for goods sold is filled in without taking into account VAT and that some transactions are not included in the list of income; a list of them can be found in the Tax Code.

The taxpayer does not always have the right to display expenses that are displayed in accounting records and, accordingly, enter them into the tax expense register. These points should also be remembered and taken into account when maintaining registers. Some costs, which are fully displayed in accounting, have limits established by the Tax Code, so they should be displayed in tax accounting only after adjustments and amendments have been made.

In Russia, tax accounting refers to the procedure for collecting and subsequent systematization of information necessary to determine the organizational tax base. Collection and systematization is carried out using information in primary documents. The procedure is based on the requirements of Article No. 313 of the Tax Code of the Russian Federation.

The concept of tax accounting

Any economic activity enterprises must be taxed, therefore information collection for subsequent taxation is the ultimate goal of accounting.

The main purpose of tax accounting is to compile a holistic and comprehensive picture of the amount of expenses and income of an institution. They determine the size of the tax base for the reporting period. Its function is also to provide reliable data to external and internal users to control the calculation processes. We should also not forget about the timeliness and completeness of paid income taxes.

The summation of various indicators is the basis for organizing the accounting procedure. Quantitative data directly proportionally influences the size of the tax base, as well as the degree of their systematization in tax registers. At the same time, they have an impact on the procedure for carrying out accounting activities, on the formation and reflection in registers of information about the object of tax accounting.

To maintain tax accounting, special forms are provided - tax accounting registers. At any time, a taxpayer’s company can be visited by a tax inspector to check tax documentation. Therefore, having completed registers is the direct responsibility of the enterprise. Violation or even refusal to maintain such documentation promises further problems with the Tax Inspectorate.

More information about the tax accounting system in the Russian Federation can be found at.

Registers

Usually, different kinds activities of the enterprise are subject to various taxes. Tax registers are forms that are developed by an enterprise and then filled with the data necessary to calculate income taxes. Tax legislation does not establish standards for the development of register forms, but has some recommendations on their type and content. Information about such registers can be found on the Consultant Plus website at this link.

Filling rules

Each register form must contain the following details:

- Name of the tax accounting register;

- Date, month and year of filling;

- A meter (or meters, if there are several of them) of the enterprise’s operations in the form of physical or material expression;

- The essence and subject of operational actions performed by the enterprise for a given period of time (business and other operations);

- Signature of the authorized person keeping these records in the register.

The main function of tax registers is to systematize information based on available source data regarding each type of tax. Thus, registers kill two birds with one stone: on the one hand, it is easier for tax authorities to monitor the company’s activities, and on the other hand, the company itself makes its life easier by having the correct tax calculation indicators at hand.

The main function of tax registers is to systematize information based on available source data regarding each type of tax. Thus, registers kill two birds with one stone: on the one hand, it is easier for tax authorities to monitor the company’s activities, and on the other hand, the company itself makes its life easier by having the correct tax calculation indicators at hand.

Data on tax records must be recorded permanently and strictly chronological order, since a different method of filling out may result in attention from the tax authorities. The taxpayer (that is, an enterprise or company) maintains analytical accounting in such a way that the order in which the tax base arises can be traced.

The storage of tax accounting registers must be carried out in accordance with several rules. You cannot simply correct any information in them. Corrections (even if they are error corrections) must be made in an authorized and legally sound manner. These actions must be confirmed by a person vested with special powers. This person can make reasonable corrections to the document, indicating the date and explanation of why he took this action.

As already mentioned, each company can have its own form of register. The main thing is that the form is convenient, has the columns and lines necessary to enter the necessary data, and is also simple and convenient to fill out. Otherwise, when checking the reporting, the tax inspector may not understand it and mistakenly fine the company. Proper maintenance of registers will relieve headaches both for the enterprise itself and for the inspection authorities.

You can fill out documentation both electronically and in paper form - the Tax Code has no restrictions in this regard. Data entry must be carried out by an authorized employee. He is responsible for maintaining registers. He must not only check the correctness of the information entered, but also ensure proper storage conditions for documents in order to eliminate the slightest chance that unauthorized persons will make any corrections. Registration of registers, as well as correction and addition of data, is certified by the signature of the responsible employee.

Tax and accounting

Organization of tax accounting can be done both in independent tax accounting registers and in accounting registers. Accounting registers, in this case, must be supplemented with details for calculating income tax. In this case, the data from tax accounting registers can:

- Be consistent with accounting data;

- Have other values that are calculated separately.

A coincidence with accounting data takes place if the requirements of both accounting methods are the same, and it is only necessary to carry out the appropriate construction of an analytical section of the accounting registers. This option is also possible because accounting rules vary with respect to the business operations of an enterprise. There is another option when the requirements of both types of registers coincide.

The second case is possible when the requirements of the first and second registers are incompatible, no matter what conditions arise.

Provided that tax accounting is carried out by accrual, then accounting registers can be used to record taxes. But it is worth noting that the cash method makes such a turn of events impossible, since there is a discrepancy between the requirements of accounting and tax accounting regarding the moment of recording business transactions.

More information about accounting and tax reporting can be found on the Federal Tax Service website at this link.

Typology

In December 2001, the Russian Ministry of Taxes and Duties introduced several key concepts related to maintaining registers, such as object, unit, indicators and tax accounting data. They have the following wording:

- The object is all the movable and immovable property of the company, as well as its obligations to other enterprises and the business operations that it carries out;

- A unit is an accounting object whose data is mentioned in several periods of tax reporting, that is, permanently;

- Indicators are quantitative data related to the accounting object;

- Accounting data – numerical indicators of the value or other characteristics possessed by the accounting object; they are reflected in tables, accounting statements and other documents of the taxpayer enterprise; this data groups information about taxable objects.

At the same time, the main names of registers for tax accounting systems were proposed, which were divided into the following five groups.

Registers for calculating intermediate values

Interim calculations are carried out by the taxpayer enterprise in these registers. The recording of indicators must be carried out in accordance with Chapter 25 of the Tax Code. Intermediate data, unlike the rest, is not included in separate columns in tax returns, that's why they are named like that. To use them, you need to make special calculations or simply add to overall indicator. The information in the registers must contain everything about the performance of intermediate calculations, as well as the indicators that are involved in their determination.

Registers for calculating business transactions

The following registers contain a storehouse of useful information about the company’s various business transactions. The tax base of the company directly depends on this type of transaction, and this happens every reporting period. Examples of a company's operations are all actions involving the purchase and sale of various objects, transactions with partner companies. This list also includes the acquisition of civil rights. But the matter is not limited to this. Thus, the Tax Code of the Russian Federation provides for expanding the list of business transactions of a company by adding to it actions related to the recognition of debts and other objects that are taxed.

Accounting registers for the status of tax accounting units

This register shows the status of an individual tax accounting unit. The entire layer of data is entered into the appropriate register during each tax period. It is very important that the information about the unit reflected its condition at each point in time during the taxation period.

Accounting registers for generating reporting data

These registers give an idea of the procedure for obtaining quantitative values for tax return lines. At the same time, information is entered into them, which is then sent to registers of intermediate settlements or accounting registers of the status of an accounting unit.

Registers for recording the accrual of funds to non-profit enterprises

This register is formed in order to summarize information on all funds and services received as a result of charitable assistance, targeted and budget revenues. Relevant mainly for non-profit and budget organizations.

More information about the taxation of non-profit organizations can be found on the Federal Tax Service website at this link.

Registers for personal income tax (NDFL)

Since the employer is a tax agent in relation to taxes on income individuals, then he is obliged to take into account the paid income of his employees. To do this, the company needs to develop its own forms of personal income tax accounting registers. Correct calculation of income tax follows from proper accounting of wages paid to employees.

Since the employer is a tax agent in relation to taxes on income individuals, then he is obliged to take into account the paid income of his employees. To do this, the company needs to develop its own forms of personal income tax accounting registers. Correct calculation of income tax follows from proper accounting of wages paid to employees.

Personal income tax registers are needed both for the tax service to establish control over employer firms, and for the enterprises themselves that use hired labor. Collecting this kind of information about employees, their wages, and all kinds of benefits provided to them allows the company to:

- Monitor the overall picture for all workers;

- At the end of the year, fill out 2-NDFL certificates;

- Determine when an employee has the right to a “children’s” deduction, and when he is deprived of such a privilege;

- Determine the possibility of other standard deductions;

- Find cases of erroneous calculation and withholding of tax collection;

- Formation of the register

- Although the Tax Code of the Russian Federation does not limit companies in how they will calculate income and the personal income tax attached to it, the code still requires the following information to be entered into the register:

- Identification data for each individual;

- Types of income paid by the company;

- Personal income tax benefits provided by the company, reducing the tax base of the enterprise;

- The amount of wages and the dates of their issue;

- Tax calculated on salaries, and the date of the calculation and transfer procedure;

- Information about payment documents confirming the transfer of tax revenue to the treasury.

IMPORTANT: Each item of the above information must be provided for each employee separately.

The development of the income tax register form is carried out taking into account the need for simple work with it, as well as the clarity of the information provided. The recommendations of the tax service must also be taken into account.

The register form must have the following features:

- Simplicity - employee information should not be confused;

- Visibility - the faster you can transfer data about workers to the 2-NDFL certificate, the more visual the form is;

- Brevity - do not overload the register with unnecessary figures and figures, so as not to complicate the perception of information.

The universalization of the register form is complicated by the fact that each company pays certain types of income and has its own characteristics of activity. Therefore, the company has the responsibility to draw up its own form, which has the necessary properties, columns and includes the necessary information. If desired, the company can produce several register forms for different types data. This will simplify tax reporting and auditing. Tax legislation only welcomes this approach. But the register form must contain the information provided for in paragraph 1 of Article 230 of the Tax Code of the Russian Federation.

Liability in case of absence of tax accounting registers or violation of their maintenance

Art. No. 120 of the Tax Code of the Russian Federation, on the one hand, provides for punishment for systematic violation of the rules for maintaining tax documents. On the other hand, these documents mean only primary documents and accounting registers. There is no mention of tax registers there, so there will be no prosecution by the tax service for violating their maintenance under this article. The penalties provided for in Articles 122 and 126 will not follow, since they do not directly relate to the violation or absence of tax registers.

Art. No. 120 of the Tax Code of the Russian Federation, on the one hand, provides for punishment for systematic violation of the rules for maintaining tax documents. On the other hand, these documents mean only primary documents and accounting registers. There is no mention of tax registers there, so there will be no prosecution by the tax service for violating their maintenance under this article. The penalties provided for in Articles 122 and 126 will not follow, since they do not directly relate to the violation or absence of tax registers.

You need to take signatures in tax registers seriously. Companies can store documentation in electronic form only with certified electronic signatures (letter from the Ministry of Finance dated July 24, 2008 under number 03-02-071-314). The same applies to other forms of document storage. They must be signed by the authorized person filling out the registers, regardless of whether the register is electronic or paper. To avoid trouble, it is good to keep a copy in paper form and with all signatures. Documentation should be printed quarterly. If it turns out that they are missing from the documents, the tax inspector may not count the expenses or refuse to deduct VAT.

Thus, these registers are mandatory documents, without which the activities of any enterprise according to the letter of the law are impossible. Their maintenance ensures timely receipt of taxes to the treasury and avoids problems with the legislation, and violations in filling out or their absence complicate the activities of the enterprise and attract the attention of tax services.

In anticipation of the upcoming filing of the income tax return for 2011, it is worthwhile to analyze the state of tax accounting registers in the organization and, if necessary, make the necessary clarifications and additions.

Life is good for the accountant whose accounting is as identical as possible to tax accounting; both of these accounting are automated and are processed absolutely correctly and in detail by the accounting and tax accounting automation program. At the same time, detailed accounting of expenses is maintained for accounting purposes and for tax accounting purposes, all differences are formed in accordance with PBU 18/02 and SHE, IT, PNA, PNO and income tax are automatically calculated in the end.

One can only envy such people. They open the profit and loss report, click the “fill in” button and, voila, here it is - an income tax calculation with attachments and transcripts, ready to be submitted to the tax office. It’s just a pity that not all accounting and tax workers can boast of this state of affairs.

But there is good news! Our article is intended to facilitate their sorrowful and difficult work, dot the t’s and provide all possible assistance in understanding and assistance in drawing up tax registers, on the basis of which it will be possible to fill out an income tax return.

1.Organization of tax accounting

In accordance with the provisions of the Tax Code, taxpayers for income tax calculate the tax base for this tax on the basis of tax accounting data (Article 313 of the Tax Code of the Russian Federation). What is tax accounting?

Tax accounting is summary information obtained on the basis of data from primary documents. It is necessary to determine the tax base for income tax. This information is grouped in accordance with the requirements of the Tax Code of the Russian Federation.

Information generated on the basis of data from primary documents is contained in accounting registers. Unfortunately, due to the differences between accounting and tax accounting, data from accounting registers is usually not enough to form the tax base for income tax. In this case, the Tax Code allowed independent addition to the organization of accounting registers.

Thus, tax accounting registers can become accounting registers if they are supplemented with the details necessary to determine the income tax base.

Why do you need tax accounting?

Tax accounting must be maintained to monitor the accuracy, completeness and timeliness of tax payments to the budget.

Tax accounting is carried out in order to ensure the completeness and reliability of information on the procedure for recording business transactions for tax purposes.

It also serves to provide information to internal and external users.

The Tax Code invites the taxpayer to independently organize a tax accounting system, consistently applying the rules and regulations of tax accounting from one period to another (Article 313 of the Tax Code of the Russian Federation).

Note:The procedure for maintaining tax accounting and methods for creating registers must be prescribed in the accounting policy for the purposes of tax accounting of the organization. For these purposes, you can use the following formulation.

Correct maintenance of registers is essential for the purposes of competent tax accounting. Registers are usually carefully examined during inspections. Violations in them are quite easy to detect. And high fines are imposed for such violations. How to avoid responsibility? The registers must be maintained correctly. Let's consider the basic rules relevant for this form of accounting.

What is a tax register?

Registers are elements of tax accounting. They are conducted by companies that pay income taxes. Registers are also required to be formed by agents.

All information necessary to establish the amount of income tax is entered into the registers (Article 314 of the Tax Code of the Russian Federation). Then this information is systematized. Based on them, it is determined.

Registers are consolidated forms for systematizing information, which are grouped on the basis of Chapter 25 of the Tax Code of the Russian Federation. However, they are not placed on the accounting accounts. The corresponding definition is given in Article 314 of the Tax Code of the Russian Federation.

Register data must answer, inter alia, these questions:

- On the basis of what documents is the tax base determined?

- What is the method of forming this base?

Article 314 of the Tax Code of the Russian Federation indicates that registers are formed on the basis of the primary register. When filling them out, you need to eliminate these shortcomings:

- Errors and typos.

- Erratic entry of information.

- Availability of passes.

NRs are filled out exclusively in chronological order.

There are rules regarding the storage of HP. They must be protected from unauthorized attempts to correct them. If errors need to be corrected, the procedure requires documentary support. Corrections must be certified.

IMPORTANT! Information from registers constitutes a tax secret: information cannot be disclosed. Otherwise, liability is imposed.

What should the register look like?

The Tax Code of the Russian Federation contains practically no information regarding the type of register. The Code only contains general information. That is, the task of preparing documents is assigned to organizations.

But Article 313 of the Tax Code of the Russian Federation specifies mandatory information that must be included in the register. In particular, these are the following points:

- Name.

- Period.

- The name of the operation performed.

- Results of the operation in rubles.

The document is certified by the signature of the responsible employee. The signature is accompanied by a transcript.

If this is a personal income tax register, it includes this information:

- Type of income.

- Personal income tax benefits that reduce the tax base.

- Payment amounts.

- Payment dates.

- Amount of calculated tax.

- Tax withholding date.

- Information about payment slips that confirm tax payment.

The rules relating to tax registers are almost identical to the rules relating to primary accounting. Therefore, some experts have a question about the possibility of replacing registers with accounting documentation. There are no prohibitions regarding this in the Tax Code of the Russian Federation. Moreover, Article 313 of the Tax Code of the Russian Federation provides indirect permission for this. But the same article states that if accounting data is insufficient, it needs to be supplemented. Based on the results of the additions, the register is formed.

ATTENTION! Registers are maintained in both paper and electronic form. Electronic documentation is simply printed if there is a need for this (for example, a tax requirement).

How to create registers

As already mentioned, the law does not prescribe a form for registers. It is determined by the organization independently. The developed form is fixed in the accounting policy. To do this, an order must be issued.

Registers can vary greatly in appearance depending on the company. There are no restrictions in law regarding form. But the taxpayer must comply general rule– the registers contain all the information required for tax accounting. From the data provided it should be clear how the tax base was formed.

Data can be grouped in different ways. The use of tables and lists is allowed. However, the grouping tool used must be included in the accounting policy.

Despite certain freedom, the taxpayer must be aware of a number of restrictions. In particular, the register must contain mandatory details. If these details are not present, the register will be considered invalid.

Income tax registers

Registers are filled out on the basis of primary records and accounting accounts. They are required to establish the amount of income tax. Register forms are developed taking into account the specifics of the company's work.

As already mentioned, tax registers can be replaced by accounting documents. But sometimes you need to create registers separately. This is relevant for transactions, the results of which are reflected differently in the tax and accounting. If an organization deals with such transactions, it is worth developing registers.

It is necessary to take into account that sometimes accounting and tax accounting standards differ.

Accordingly, the documents for accounting must be different. This is where tax registers come in handy.

If an organization deals only with transactions that are equally documented from the point of view of both tax and accounting, separate registers are not required. They are simply replaced by accounting registers. A single form saves time and makes calculations easier.

To generate an income tax return, you will need at least two tax registers: for income and expenses. Information about income and expenses is needed to determine the amount of profit. It is this that is the tax base, on the basis of which the amount of tax is determined.

Two registers are the bare minimum that will be useful in calculations. Sometimes auxiliary registers are introduced. They are relevant when the organization is engaged in several areas of activity at once. Registers should be created when a company is faced with special transactions that require a special procedure for the formation of the tax base.

Is it possible not to develop register forms?

What to do if representatives of the organization do not want to develop register forms? In this case, there is a risk of imposing liability on the basis of Article 120 of the Tax Code of the Russian Federation. To avoid penalties, a company can simply take existing forms. A list of them is contained in the recommendations of the Ministry of Taxes and Taxes “system for establishing profits” dated December 19, 2001.

Examples

There are two main forms of register. These are registers that reflect income and expenses. But if necessary, additional forms can be added to them. For example, one organization may have the following registers:

- Proceeds from sales.

- Expenses that reduce sales revenue.

- Non-operating expenses.

There may be more registers. It all depends on the needs of a particular company. For example, you can enter these HP:

- Revenue from the sale of goods of own production.

- Revenue from the sale of goods that were previously purchased in bulk.

- Revenue from the sale of other products.

When registering each register, you must adhere to the provisions of the Tax Code of the Russian Federation. For example, when filling out the “Sales Income” register, you need to remember that revenue should be recorded excluding VAT and excise taxes. The corresponding rule is given in paragraph 1 of Article 248 of the Tax Code of the Russian Federation.

To fill out such a register, you need to use information from accounting. In particular, accounts 90 and 91. Accounting data and information in registers should not contradict each other.

Taxpayers for corporate income tax are required to maintain analytical tax accounting registers. The Tax Code of the Russian Federation establishes that register forms and the procedure for reflecting analytical tax accounting data in them are developed by the taxpayer independently and are established by appendices to the organization’s accounting policies for tax purposes. The 1C: Accounting 8 program has more than 30 specialized reports for compiling tax report registers. For most taxpayers, this may be sufficient to satisfy their tax accounting requirements. In the article, Doctor of Economics, Professor S.A. Kharitonov talks about maintaining tax accounting registers for the purpose of calculating income tax using the example of the 1C: Accounting 8 program (rev. 3.0).

Requirements for tax accounting registers

Tax accounting data is confirmed by:

- primary accounting documents (including an accountant’s certificate);

- analytical tax accounting registers;

- calculation of the tax base.

Analytical tax accounting registers are understood as consolidated forms of systematization of tax accounting data for the reporting (tax) period, grouped in accordance with the requirements of Chapter 25 of the Tax Code of the Russian Federation.

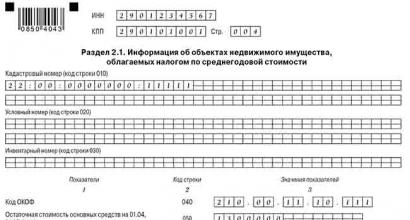

The forms must contain the following details:

- register name;

- period (date) of compilation;

- name of business transactions;

- transaction meters in monetary and in kind (if possible) terms;

- signature (deciphering the signature) of the person responsible for compiling the register.

The forms of registers and the procedure for reflecting analytical data of tax accounting in them, according to Article 314 of the Tax Code of the Russian Federation, are developed by the taxpayer independently and are included in the annex to the accounting policy for tax purposes.

Tax accounting registers "1C: Accounting 8"

The 1C: Accounting 8 program (rev. 3.0) has more than 30 specialized reports for compiling tax report registers.

Their list is given on the form Tax accounting registers In chapter Accounting, taxes, reporting(Fig. 1).

According to their purpose, the analytical registers of tax accounting "1C: Accounting 8" are divided into the following groups:

- Registers of accounting of business transactions;

- Registers for recording the status of a tax accounting unit(registers of information about changes in the state of an accounting object);

- Registers of intermediate settlements;

- Registers for generating reporting data.

Business transaction registers are intended to summarize information about the facts of the activities of an economic entity that lead to the emergence of a tax accounting object.

Registers for recording the status of a tax accounting unit are designed to collect information about the availability and movement of tax accounting objects.

Registers of intermediate settlements perform an auxiliary function: they are used at the stage of forming the cost of an accounting object, and also as a source of information for filling out registers for generating reporting data.

are intended to summarize information about recognized income and expenses of the reporting (tax) period, calculate the tax base and decipher individual income and expenses in the income tax return.

For most taxpayers, the registers generated in the 1C:Accounting 8 program may be sufficient to comply with the requirements of the Tax Code of the Russian Federation regarding confirmation of tax accounting data.

On the form Tax accounting registers reports for compiling registers are arranged in the reverse order (unlike “1C: Accounting 8” (rev. 2.0)), that is, first there are reports for compiling registers for generating reporting data, then reports for compiling registers for intermediate settlements, etc. ( see Fig. 1). This is due mainly to ergonomic considerations. Reporting data generation registers Taxpayers often have to file, usually multiple times for the same period, to ensure the correctness of the corporate income tax return.

To compile a register, you need to double-click on the name to open the corresponding report form, indicate the period, organization and click on the button Generate a report.

Registers are formed according to tax accounting data in the accounts of the chart of accounts of accounting "1C: Accounting 8". When compiling a register of information about a fixed asset object, information about accounting objects is additionally used, which is stored in special registers.

Tax accounting registers "1C: Accounting 8" have a unified design form and contain all the required details (Fig. 2).

The person, position and signature of the person responsible for compiling the register, which must be displayed in the register form, are indicated in the list Responsible persons of the organization.

The reports provide the ability to configure grouping and data selection (tab basic settings), as well as including additional information about accounting objects in the register, sorting data and register design (tab Additional settings).

In the generated register, it is possible to open a document with which the transaction is reflected in tax accounting.

For example, for a tax accounting register Income from the sale of goods, works, services it will be Retail sales report.

Help and calculations

For certain types of expenses, the Tax Code of the Russian Federation establishes special rules for determining the amount of expenses taken into account when calculating the tax base of the reporting (tax) period. So, the costs of voluntary insurance, on individual species advertising, entertainment expenses are taken into account in the expenses of the period according to the standard; based on transportation costs, the amount of expenses related to goods sold is determined; For depreciable property, the taxpayer has the right to apply a depreciation premium of up to 30% initial cost(expenses “for modernization”); direct costs of production and sales of products must be distributed between sold products and products in warehouse, etc. Necessary calculations for such expenses in “1C: Accounting 8” are made when performing the corresponding routine operations for closing the month, and for documentary confirmation of calculations (confirmation of tax accounting data for a routine operation) the program provides Help and calculations. Their list is given on the form Help and calculations In chapter Accounting, taxes, reporting(Fig. 3).

Help and calculations Depreciation bonus, Cost rationing And Write-off of losses from previous years are intended to confirm tax accounting data only (in accounting, bonus depreciation is not applied, expenses are not normalized, losses of past years are not carried forward to the future). Other certificates-calculations (with the exception of certificates-calculation Tax assets and liabilities And Restatement of deferred tax assets and liabilities) are intended to confirm both accounting and tax accounting data.

To compile Help for calculations You need to double-click on the name to open the form of the corresponding report, specify the period of compilation, organization, and set the switch on the main settings panel Indicators to position NU (tax accounting data) and press the button Generate a report.

Detailed information about the purpose and procedure for compiling tax accounting registers, as well as certificates and calculations confirming tax accounting data in “1C: Accounting 8” can be found on the ITS in the reference book “Accounting for corporate income tax”.

From the editor. Read about the formation of accounting registers in the 1C: Accounting 8 program in issue 7 (July) of BUKH.1C for 2013. With the procedure for generating accounting registers in electronic form with signing with an electronic signature and storing them in information base The example of “1C: Accounting 8” (rev. 3.0) can be found in issue 9 (September) of “BUKH.1C” for 2013.