Is it possible to hire a part-time employee if this will be his only place of work? Procedure for hiring a part-time (part-time) job How 0.5 of the rate is paid.

Part-time work is understood as the performance by an employee of another regular paid job under the terms of an employment contract in his free time from his main job (Part 1 of Article 282 of the Labor Code of the Russian Federation). When working part-time, the duration of working hours is legally limited. As a general rule, it should not exceed half of the monthly working time standard (working time standard for another accounting period) established for the corresponding category of workers (Part 1 of Article 284 of the Labor Code of the Russian Federation).

According to Part 2 of Art. 57 of the Labor Code of the Russian Federation, the condition on remuneration, including the size of the tariff rate or salary (official salary) of the employee, additional payments, allowances, incentive payments and the condition on working hours, if for a given employee it differs from the general rules in force with the employer, is mandatory included in the employment contract.

Remuneration for persons working part-time can be made (Part 1 of Article 285 of the Labor Code of the Russian Federation):

- in proportion to the time worked;

- depending on output;

- on other conditions specified in the employment contract.

In the situation under consideration, the parties chose the first option for remunerating the part-time worker.

Please note that when filling out the staffing table, the number of staff units for the relevant positions (professions), which provide for the maintenance of an incomplete staff unit, taking into account the characteristics of part-time work, is indicated in the appropriate shares, for example 0.25; 0.5; 0.75 and so on. However, the salary amount is indicated for a full staff unit, because the staffing table determines only the salary for the corresponding position, and not the salary of a specific employee.

Salary is a fixed amount of remuneration for the performance of labor duties of a certain complexity for a calendar month, excluding compensation, incentives and social payments (Part 4 of Article 129 of the Labor Code of the Russian Federation). In other words, the salary is paid to the employee for fulfilling the monthly working hours.

Therefore, if the position provides a salary of 10,000 rubles, and the employee is hired at “0.5 rate”, i.e. his working hours are half the norm, which means the part-time worker’s salary is 5,000 rubles. (RUB 10,000 / 2). It is this value that is fixed in the employment contract, which fully complies with the requirement of Part 1 of Art. 132 Labor Code of the Russian Federation. If, however, in the employment contract of a part-time worker, which is accepted at 0.5 rates, the salary value is determined to be 10,000 rubles, then it turns out that the parties agreed on exactly this amount of remuneration for the calendar month worked.

Please note that the employment contract must contain other conditions listed in Art. 57 of the Labor Code of the Russian Federation and subject to mandatory inclusion in the employment contract. However, the condition of the employment contract that the official salary is a certain amount before payment of personal income tax (NDFL) does not apply to these. At the same time, the specified additional terms of the employment contract themselves do not contradict the current legislation (see, for example, the appeal ruling of the Investigative Committee for civil cases of the Moscow City Court dated May 16, 2012 No. 11-5036/2012, the ruling of the Investigative Committee for civil cases of the Moscow City Court dated January 18, 2012 in case No. 33-1205, cassation ruling of the St. Petersburg City Court dated October 20, 2011 No. 33-15808/2011, appeal ruling of the Investigative Committee for civil cases of the Supreme Court of the Republic of Karelia dated November 5, 2013 in case No. 33-3581/ 2013).

Thus, when in the organization’s staffing table the number of staff units for a certain position is 0.5, and the salary according to the staffing table is 10,000 rubles, then, in our opinion, when hiring an employee on a part-time basis in the situation under consideration, the payment conditions labor in an employment contract may be as follows: “The employee’s remuneration consists of an official salary in the amount of 5,000 rubles. per month before withholding personal income tax in the amount and manner established by current legislation.”

In the employment contract of a part-time employee, the parties have the right to indicate the amount of salary for a full-time salary - 10,000 rubles. before withholding personal income tax, but with the proviso that the employee is paid in proportion to the time he works.

Is it possible to hire an employee at 0.5 rate if this is his only place of work? If so, how do you comply with minimum wage regulations?

Having considered the issue, we came to the following conclusion:

The employer has the right to hire an employee for 0.5 staff positions. At the same time, the norms on the minimum wage as the main state guarantee for wages will not be violated.

Rationale for the conclusion:

The employer has the right to independently determine the structure and number of employees of the organization, taking into account the specifics of its activities and needs, work technology, demand for manufactured products, plans for further development, etc. The structure, staffing and strength of the organization are determined in the staffing table (form N T-3, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1).

According to the Instructions for the use and completion of forms of primary accounting documentation for the accounting of labor and its payment, approved by the same resolution of the State Statistics Committee (hereinafter referred to as the Instructions), the staffing table contains a list of structural divisions, the names of positions, specialties, professions indicating qualifications, information on the number of staff units . Column 4 of the T-3 form indicates the number of staff units for each position (profession, specialty) of the organization. At the same time, when filling out column 4, the number of staff units for the relevant positions (professions, specialties), which provide for the maintenance of an incomplete staff unit, taking into account the characteristics of part-time work in accordance with the current legislation of the Russian Federation, is indicated in the appropriate shares, for example 0.25; 0.5; 2.75 and so on.

Thus, the Directions allow for the possibility of designating incomplete, fractional staffing units in the staffing table. Obviously, the number of working employees cannot be fractional. Consequently, the number of employees may not correspond to the number of staff units. Therefore, if two people are hired for a position (specialty, profession), then the staffing table may indicate two fractional staffing units for this position (specialty, profession), which in total form one whole unit. In other words, one full staff unit recorded in the staffing table means the employer’s need for the work of one employee during normal working hours. The staffing unit indicates the volume of work for a position, and not the number of employees performing it.

The Labor Code of the Russian Federation does not define such a thing as a rate. Based on the meaning of the term, working in a specific position for the entire normal working hours is considered full-time work. Accordingly, if an employee works part-time, then it is assumed that he must work half of the normal working time, that is, work in this position part-time (week).

Therefore, if an employer is interested in hiring an employee who will perform his duties for half of the normal working hours, then he has the right to hire such an employee for 0.5 staff positions. Moreover, if such an employee does not have another place of work, then he must be hired according to the general rules established by Chapter 11 of the Labor Code of the Russian Federation, and this place of work will be his main place of work.

Obviously, such an employee will earn less than his full-time colleague. After all, by virtue of part one of Art. 132 of the Labor Code of the Russian Federation, the salary of each employee depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended.

According to part three of Art. 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage (hereinafter referred to as the minimum wage). Accordingly, if an employee works part-time (occupies a position for which the staffing table provides for a number of staff positions that is less than one), his salary must be no less than the corresponding part of the minimum wage. For example, if an employee fills a position for which 0.5 staff positions are provided, his salary cannot be less than half the minimum wage. The norms of labor legislation establishing the minimum wage as the main state guarantee for remuneration of workers will not be violated.

Solovyov Oleg - expert of the Legal Consulting Service "GARANT"

There are two ways to hire an employee to work half-time, either by reducing the working day or the number of days of work per week. This regime is initially negotiated with the employer and specified in the employment contract. Payment is made in proportion to the time worked, there are no other restrictions.

Part-time work may be established by special order of government bodies for certain categories of workers:

- for a pregnant woman,

- a parent whose child is under 14 years old,

- if the employee has a disabled child who has not reached the age of majority,

- if there are family members who need constant supervision, a medical certificate is provided

Hiring a part-time employee is carried out in the same way as a full-time employee, with the provision of a full package of documents, namely:

- Passport

- Identification code

- Insurance certificate (SNILS)

- Medical insurance, for certain positions it is obligatory to undergo a medical examination

- Education document

- Employment history

- Personal card – issued according to general requirements

Registration of an order for employment on a part-time basis

When applying for a job, be it half-time or full-time, the personnel officer is obliged to issue an order in the T-1 form and present it to the employee no later than within three days against signature.

In the order we indicate:

- OKPO organization and its name

- Number and date of compilation

- We assign a personnel number

- Specify employee details

- His salary

- Working conditions, in which you specify how and how long the employee will work

- We will write down the date and number of the employment contract as a basis.

- At the end the employee's signature

IMPORTANT!!! The salary is indicated in the order in full

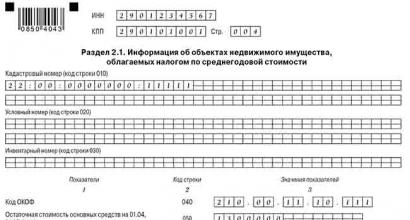

The order looks like this:

Unified form No. T-1

Approved by the Resolution of the State Statistics Committee of Russia

dated 01/05/2004 No. 1

| Code | |||

| OKUD form | 0301001 | ||

| according to OKPO | |||

(name of company)

(order)

about hiring an employee

(Full Name)

| bonus | rub. | cop. | ||

| (in numbers) |

| with time trial | month(s) |

Base:

| Employment contract from “ | ” | 20 | city no. |

Concluding an employment contract with an employee

IMPORTANT!!! In an employment contract, the main thing is to specify in the “Work and rest schedule” section the number of hours that the employee must work.

For example:

The employee is assigned part-time working hours:

Working hours four days a week: Monday, Tuesday, Wednesday, Thursday

– days off: Friday, Saturday, Sunday

– working hours from 9.00 to 13.30 with a lunch break

The salary in the employment contract is stated in full, but half of the specified amount will be accrued.

Making an entry in the work book

The entry in the work book is made in the general manner; it does not indicate that the employee is hired on a part-time basis

Example of calculating wages for a part-time employee

The calculation is carried out according to the following formula

salary for 0.5 rate = employee's salary for full time * 0.5;

Ivanov V.G. has been working for Polyus LLC since July 1, 2017, with a salary specified in the employment contract in the amount of 16,000 rubles, let’s calculate his income when working half-time.

16000*0.5=8000 rubles

He has a child under 18 years old, so we will provide him with a personal income tax deduction in the amount of 1,400, then the personal income tax will be 78 rubles.

The amount of insurance premiums will be:

- Contributions to OPS 22% 1760

- Medicine 5.1% 408

- Social insurance 2.9% 232

- Accidents 0.2% 16

Thus, our employee will receive 8000-78 rubles = 7922 rubles working half-time

Answers to frequently asked questions

Question #1:

How to hire a part-time employee, what documents should I fill out?

For a more correct answer, let's decide whether we employ a person as an external or internal part-time worker, whether it will be his main job or a part-time job. In any case, draw up an employment contract and specify working hours.

If it is your employee who will combine two jobs for different pay, then here you can just draw up an additional agreement and will not need to make changes to the timesheet. Then it won’t be a part-time job, he’ll just be doing another job at the same time.

The second option is an internal part-time job, this is when this employee is accepted (precisely accepted) for this position, another employment contract is concluded with him, but already for this position, it is indicated there that the employee is hired on an internal part-time basis, he will work 4 hours a day, and within one month the duration of working hours when working part-time should not exceed half of the monthly standard working time. Remuneration is made in proportion to the time worked for the position specified in the employment contract. And the employee performs this work in his free time from his main job.

Now look at the disadvantages, when you fire him from a part-time job, you will have to pay him vacation compensation upon dismissal, if he quits both his main job and his part-time job, then you pay him two compensations for both his main job and his part-time job, just like You provide both primary and part-time leave and double pay. In the time sheet, this employee must be recorded both in his main job and in his part-time job, i.e. he will have two lines.

You can conclude a part-time employment contract as a fixed-term one, but in this case, it will be terminated only when the term expires early; the employer does not have the right to terminate it, and this may not be beneficial to the employer, or it is open-ended, in which case the employer can terminate the contract by warning the employee in two weeks, but if it is a pregnant woman, then you will not be able to terminate an open-ended employment contract with her, because this will be the initiative of the employer.

There are times when it is necessary to register a person for 0.5 bets. This is done by agreement of the parties, that is, both parties to the employment contract must agree with these working conditions. To be appointed, you need to issue an order for employment at 0.5 rates; we suggest downloading a sample of filling out the T-1 form in this article below.

When hiring a part-time employee, it is worth considering that the concept of 0.5 wages is not officially established in Russian labor legislation; instead, the definition of part-time work appears. Filling out an employment order under such conditions involves some features that will be discussed below.

First of all, it is worth remembering that the employment order is issued in strict accordance with the signed employment contract. Therefore, the employment contract must stipulate that the employee is employed on a part-time basis (at 0.5 times the rate) - sample.

An employee can be hired for a limited period; this point must be reflected in the order - sample.

Sample of filling out an order for acceptance for 0.5 bets

Until 2013, all admission orders were filled out exclusively according to. Since 2013, legislation has provided for the possibility of organizations and enterprises to develop their own forms of such documents on personnel. The main feature when placing an order for a part-time job is to fill out the section that specifies the conditions of admission (rate) and the specific mode of work (character). Here you need to state that the employee is employed on a part-time basis (not at 0.5 rate or 0.25 rate, but part-time). And then register the operating mode.

The working hours at 0.5 rates may vary and are selected individually, depending on the type of work and the employee’s capabilities. But the main condition is that in a week equal to 40 working hours, an employee hired on a part-time basis must work 20 hours per working week. Therefore, he can be assigned a 4-hour working day with two days off, or 2 full working days and one 4-hour working day per week. At the same time, in the nature of work column of the T-1 acceptance order form, the hours and minutes of the beginning and end of work, or specific working days on which the employee is present at his workplace for all 8 hours, are written down.

After determining the nature of the work and the conditions of admission in the T-1 form or your own admission order form, the same column states that payment is made in proportion to the actual time spent on the work. Therefore, the order indicates the full tariff rate provided for in the staffing table, and not half of it.

Labor legislation allows any person who wants to find a job to choose the most convenient option with a suitable work schedule. For example, if a person cannot be busy all day, he may well agree to part-time work. The only condition for such employment is documentation.

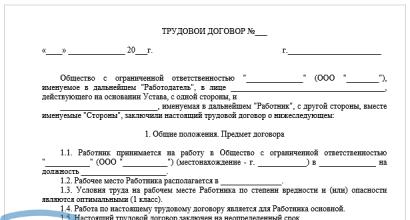

In this article we will look at all aspects that relate to how a part-time employment contract is drawn up, as well as a sample for filling it out.

It is assumed that for part-time work a person must complete the duties assigned to him within less than the allotted time. Here it is important not to compare, and especially not to confuse the concepts of “part-time work” and “short-time work.” In the first option, everything is drawn up on the basis of the free will of the parties, but in the second, the employee must follow the instructions of the employer. Quite often, such a situation arises due to objective circumstances, for example, financial difficulties, a change in the specifics of work, the introduction of new software, etc.

A part-time employment contract is possible in the following cases:

- If there is an application from the employee and if the employer does not mind.

- If the employee is pregnant and enjoys the rights that are enshrined in Article 93 of the Labor Code of the Russian Federation.

- If the employee is a single mother and is raising a child who is under 14 years old, or she has a disabled child under 18 years old.

- If the employee provides care to a sick relative, for which there is appropriate medical evidence.

In all of the above situations, the employer does not have the right to refuse an employee his desire to work part-time. If this right is violated, the person may apply to the court with a corresponding statement of claim.

Kinds

It is necessary to understand that the procedure for concluding and the form of an employment agreement is the same for both full-time and part-time work. Along with this, such an agreement can be fixed-term or indefinite, which is decided at the request of the head of the enterprise or organization, and also depends on the specifics of the work.

As a rule, a standard agreement consists of the following sections:

- general provisions;

- item;

- rights and obligations of the parties;

- procedure for resolving controversial issues;

- Force Majeure;

- requisites.

The agreement may be amended at the request of the parties, if necessary.

Urgent

Describes all the nuances of concluding a fixed-term employment contract. This type involves drawing up an agreement without fail, no matter what official labor relations exist between the employee and the employee. The validity period of such an agreement does not exceed 5 years. Before the end of a fixed-term employment agreement, the employer is required to notify the employee 3 weeks in advance.

Basically, if the parties wish to extend the cooperation, the employment contract does not expire and becomes indefinite.

Indefinite

This type of employment agreement is a written agreement between an employee and an employer for an indefinite period of cooperation. If there is a need to transfer such a person to part-time work, there will be no need to terminate such an agreement, since its text does not specify the working hours when exactly the employee must work.

The legislative framework

A person working under an employment contract at 0.5 rate must work at least a quarter. The fact is that according to current legislation it is impossible to get a job for less than 0.25 times the salary.

The main feature of such legal relations is that it is not always possible to draw up a part-time employment contract. For example, in the civil service, this type of employment option is not practiced. In other cases, this is quite acceptable, but only if it occurs by mutual consent of the employee and the employer. Thus, the forced transfer of a person to part-time work is impossible, which is also enshrined in the current legislation.

It is worth turning to a country that provides that certain segments of the population have the right to enter into a part-time employment agreement, and the employer does not have the right to refuse them. Such persons include:

- pregnant women;

- mothers who have a child under 14 years of age;

- persons who look after the disabled.

What documents are required to conclude an employment contract?

In order for a person to be transferred to part-time work, it is necessary to write a corresponding application. After reviewing the paper, the company issues an Order, which indicates exactly how the employee will work now.

As for the list of papers that must be provided in order to draw up an agreement with an employee, an exhaustive list can also be found in the current legislation. In particular, Article 65 of the Labor Code of the Russian Federation contains a direct indication of what official documents must be provided if a person is transferred to a shortened working day.

Such papers include:

- passport;

- work book;

- insurance document on compulsory pension insurance;

- military registration paper for those who are liable for military service;

- certificate of presence or absence of criminal record;

- education document;

- a certificate stating that the person is (is not) subject to administrative punishment for the abuse of narcotic or psychotropic substances that were used by the person without a doctor’s prescription.

In some cases, taking into account the specifics of work at an enterprise or organization, other official papers may be required when concluding an employment agreement. Labor relations are regulated by various legal acts, and some of their features may be prescribed in federal laws, decrees of the President of the Russian Federation, and decrees of the Government of the country.

How is an employment contract drawn up?

An employment agreement for 0.5 wages is drawn up as standard, and there is no difference with how a person is registered for a full-time job. However, there are regulations that put forward certain requirements for how the text of the document itself should look.

Thus, when drawing up an agreement for 0.5 wages, special attention is paid to working conditions, which directly indicate that the person will work part-time.

Let's look at the list of what should be in an employment agreement concluded with someone who wants to work part-time:

- the place of work must be clearly indicated if the legal and actual addresses of the enterprise or organization differ;

- a clear indication of what is included in the employee’s job responsibilities;

- start and end times of the working day;

- how exactly the payment will be made;

- detailed description of the work schedule;

- terms and conditions of personal insurance.

If you want to see what an employment contract with a part-time employee looks like, a sample can be found here.

In addition, the employer has the right, at his own request, to supplement the employment contract with certain conditions, while taking into account all the features of part-time work. So, it is worth pointing out the following features:

- the clause on the employee’s remuneration must contain comprehensive information on all issues, in particular, it must be indicated that the total amount is determined based on the time worked by the person;

- regardless of what work schedule a person works on, annual leave must be taken out in any case and in full;

- as for length of service, it is determined according to general rules, that is, there can be no talk of any recalculation to hours worked;

- The minimum number of hours worked by a person each week is not required.

Important!

In the event that the hours are nevertheless indicated, everything that was worked in excess of the established norm, according to the law, is considered overtime.

As for other clauses of the labor agreement at 0.5 rates, they are drawn up in accordance with the standards enshrined in the Labor Code of the country.

Dismissal of an employee

As for terminating the employment contract, this happens not only on the initiative of the employee, it can also happen due to the fact that its term simply expires. If this happens in this way, it is imperative to adhere to the established procedure.

Thus, the expiration of the contract is considered one of the reasons for the dismissal of an employee, that is, the termination of a working relationship with him. All the nuances of such legal relations can be found in the Law, in particular in the Labor Code of the Russian Federation.

However, if a contract expires, this does not always mean that it ceases to be valid. And all because many contracts have a prolongation clause, which mostly happens automatically. So, for the contract to end, certain conditions must be met on the part of the employer or employee. For example, if neither the employee nor the employer took any action upon expiration of the contract, it will be considered extended. Namely, if the employer has not notified his employee in writing that he wishes to sever the working relationship with him, the contract is automatically recognized as unlimited.