The main thing is in June. Procedure for inventory of fuels and lubricants How to dispose of excess fuels and lubricants

The filling height is taken to be the average measurement value, rounded to 1 cm. 4.2.5. Determining the filling height remotely (from the control panel) during inventory is not allowed. 4.3. Sampling 4.3.1. Fuel samples are taken in accordance with GOST 2517-85. 4.3.2. Fuel samples must be taken sequentially from top to bottom. 4.3.3. Point samples from vertical tanks to compile a combined sample (see Appendix 1) are taken with portable samplers from three levels: the top - 250 mm below the fuel surface; middle - from the middle of the height of the fuel column; lower - 250 mm above the bottom of the tank. Samples from the upper, middle and lower levels are mixed in a ratio of 1:3:1. 4.3.4. When the fuel level in the tank is no more than 2000 mm, spot samples are taken from the upper and lower levels according to clause 4.3.3.

Inventory of fuels and lubricants at the enterprise

Attention

The act of removing residual fuel from car tanks is used to monitor the use of fuel and lubricants by drivers. Each enterprise establishes with its accounting policies the rules and deadlines for performing control functions. This norm is especially important for organizing order and reliability in accounting for fuel and lubricants.

The availability of fuel is checked by a commission, which is appointed by the manager and consists of heads of departments, accounting departments, and technical workers. Remaining withdrawals are made monthly. According to the report, a statement is drawn up, which establishes the result of using fuel and lubricants for the month. This act is drawn up in one copy and filled out manually or using computer technology.

When entering information, you must indicate the date on which the document is drawn up and the composition of the commission.

Features of inventory of fuels and lubricants in institutions

If necessary, the weight of sealed containers is rechecked. To ensure reliable assessment of the volume and quantity of fuels and lubricants in tanks and containers, measuring equipment is used: meter rods, metal tape measures with weights, etc. To measure unused fuel in car tanks, use a measuring stick.

The act of removing fuel residues from car tanks

Persons responsible for the safety of fuels and lubricants give a receipt stating that by the beginning of the inventory, all consumable and incoming documents for fuels and lubricants were submitted to the accounting department and all fuels and lubricants that arrived at the warehouse under their responsibility were recorded, and those disposed of were written off as expenses. 7.8. In the event of a change in financially responsible persons, both persons are present during the inventory, and in the act of removing the remains of fuel and lubricants, the person who accepted the fuel and lubricants signs for their receipt, and the person who delivered them signs for their delivery. Reception and transfer of fuel and lubricants is carried out according to their actual quantity, taking into account the natural loss and error of measuring instruments.

7.9. Before conducting an inventory, pipelines must be completely filled or emptied. Control is carried out using air valves installed on elevated or lower sections of the pipeline.

7. content and procedure for carrying out fuel and lubricants inventory

RULES for technical operation of power plants and networks. M.: Energoizdat, 1977. 10. TYPICAL instructions for the operation of fuel oil facilities of thermal power plants.: TI 34-70-009-82. SPO Soyuztekhenergo, 1982. 11. GOST 26976-86. GSI. Oil and petroleum products.

Mass measurement methods. 12. RULES for fuel accounting at power plants. M.: SPO Soyuztekhenergo, 1982. CONTENTS 1. General part. 1 2. Safety precautions during inventory. 2 3.

Inventory of fuels and lubricants at the enterprise

7 List of used literature.. 7.

After approval, the commission submits one copy of the Act to the financial department, and the second to the head (storekeeper) of the fuel and lubricants warehouse. 7.20. In cases of detection of shortages or surpluses in excess of permissible measurement errors, the commission conducts a thorough investigation. Those responsible for this will be held accountable.

For all shortages and surpluses, the commission must receive written explanations from financially responsible persons. Explanations are attached to the act of withdrawal of balances. In the case when, when setting off shortages with surpluses by re-grading, the cost of the missing fuel and lubricants is higher than the cost of the fuel and lubricants found in surplus, this difference in cost should be attributed to the guilty parties. The procedure for writing off shortages and receiving surplus fuel and lubricants is determined by the current “Regulations on Accounting Reports and Balance Sheets.” 7.21.

How to measure gasoline in a tank during inventory

In cases where the chairman of the commission is temporarily unable to perform his duties for valid reasons (illness, vacation, study, etc.), by order of the head of the airline, a temporary new chairman is appointed from among the members of the inventory commission. 7.4. Members of inventory commissions for entering into the act of removal of residuals deliberately incorrect data on the actual balances of fuel and lubricants in order to conceal their shortages, waste or surpluses are subject to liability in the manner prescribed by law. 7.5. The inventory of fuels and lubricants is carried out on the first day of each month following the reporting month in the presence of the head of the fuels and lubricants warehouse or another financially responsible person. The inventory must be carried out with the full composition of the inventory commission.

Fuel and lubricants in the warehouses of VT enterprises are carried out in order to compare the actual availability of each brand of fuel and lubricants, measured in units of mass on the day of inventory in tanks, process pipelines, refueling means (TZ, MZ), small containers and other containers, with accounting data on movement and storage of fuels and lubricants for the reporting period. 7.2. Inventory is carried out without fail: - within the time limits established in accordance with the “Regulations on Accounting Reports and Balance Sheets” (for oil and petroleum products - at least once a month); - in case of a change of financially responsible persons - on the day of acceptance and transfer of cases; - when establishing facts of theft, robbery, theft or abuse, as well as damage to fuel and lubricants - immediately following the establishment of such facts; - after a fire or natural disaster (flood, earthquake, etc.) - immediately after the end of the fire or natural disaster. 7.3.

During the inventory, working and “dead” (Appendix 1) fuel residues are determined at actual humidity and for “dry” weight (minus operating humidity). 1.7. After the inventory, an act is drawn up in accordance with Appendix 2, in which the results of measurements and calculations are entered. The act is approved by the director of the power plant. 1.8. Fuel is taken as a “dead” residue: - in supply tanks - at a level exceeding by 20 cm the mark at which the pumps fail at the nominal hourly fuel consumption at the power plant, taking into account the flow rate in the recirculation line; - in reserve tanks - what remains after the failure of one pump-out pump at 30% supply; - in receiving tanks - at a level 10 cm higher than the mark at which one transfer pump fails at its nominal flow. 1.9.

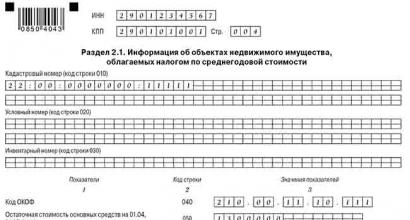

Total balance: at actual moisture content 14385.421 tons; for dry weight 14037.042 tons. Note. In columns 9 and 10, the fuel mass is indicated as a fraction: in the numerator - at actual humidity, in the denominator - per dry weight. The measurement was carried out by the Chairman of the commission Signature Members of the commission Signature Measured parameters, operation Name of the device, GOST Characteristics of the device Additional instructions Fuel level in the tank Float level gauges with spring balancing according to GOST 13702-78 and TU 25-070374-79.

Measuring metal tape 10 and 20 m long according to GOST 7502-80 Measurement error at local reading ±4 mm. The division value is 1 mm. The use of other types of level gauges with the specified error is allowed. Sampling Samplers in accordance with GOST 13196-85 and GOST 2517-85. Portable samplers in accordance with GOST 2517-85 Provides the collection of combined samples.

Audit of non-cash payments using the example of PTF Rodnik LLC

1. Features of the audit of PTF Rodnik LLC

Audit of bankrupt enterprises

CHAPTER 2. Features of inventory of fuels and lubricants in institutions

FEATURES OF AUDITING INSOLVENT ENTERPRISES

Taking into account the target orientation of the various stages of bankruptcy, defined by the Federal Law “On Insolvency (Bankruptcy)” dated October 26, 2002 No. 127-FZ, we can conclude...

Accounting in the organization Master-Food LLC

2.1 Procedure for conducting inventories

The rules for conducting an inventory are determined by the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 in accordance with a number of adopted regulations...

The importance of inventory in the formation of accounting

2. Types of inventories

Depending on the various characteristics and reasons why the inventory is carried out, its types are distinguished. 1. In relation to the implementation plan, in accordance with the accounting policies of the organization, a distinction is made between scheduled and unscheduled inventory...

Inventory

Types of inventories

Inventories are divided into: Mandatory - carried out without fail in accordance with the legislation of the Russian Federation; Initiative - carried out by decision of the manager; Planned - carried out in accordance with the established procedure...

1.3 Procedure for conducting inventories

The procedure for conducting inventories at an enterprise involves the creation of permanent inventory commissions consisting of: the head of the enterprise or his deputy (chairman of the commission); chief accountant; bosses...

Inventory as an element of the accounting method

1.2 Classification of inventories

The most detailed classification was given by accountant Pietro d'Alvise in 1934. He identified eight classification bases: 1. by volume (full, partial); 2. by affiliation (property in the organization and outside it); 3. by purpose (introductory, subsequent…

Inventory as an element of the accounting method using the example of AromaLux LLC

1.2 Classification of inventories and basic requirements for their implementation

Let's consider the main types of inventories presented in Figure 1. Posted on http://www.allbest.ru/ Figure 1 - Types of inventory According to the scope of inventory checks, there are: - complete; - incomplete (partial) ...

Mandatory audit

1. Statutory audit: concept, objects, tasks and features of implementation

mandatory audit documentation To officially confirm the accuracy of accounting and tax reporting, a number of organizations are subject to mandatory audit...

Organizational and technical features of conducting an audit using software tools

1. Organizational and technical features of conducting an audit using software

Features of internal audit

1.2 Internal audit of branches: features of implementation. Features of organizing internal audit in a small enterprise

Opening branches brings many serious problems to companies. These include distance from the head office, an increase in administrative and business expenses, and possible financial mistakes by branch managers...

The procedure for conducting inventory and revaluation of inventories (using the example of the Municipal Health Institution "City Clinic No. 11")

Chapter 1. Inventory at the Municipal Health Institution “City Clinic No. 11”: procedure and features

Audit of operations for accounting of economic activities in Ivyevsky RAIPO

2.2 Organizing inventories of products and goods and monitoring their results

One of the most important means of monitoring the safety of property is an inventory, in which the safety of valuables is checked and their actual presence is compared with accounting data...

Inventory technique at Promtractor-Promlit LLC

1.2 Classification of inventories carried out in organizations

All inventories carried out in the organization are divided according to a number of characteristics: 1. By volume - full and partial; 2. According to the method of conducting - selective and continuous; 3. By purpose - planned, unscheduled, repeated, control...

Elements of the accounting method in identifying and investigating economic crimes

4. Features of organizing and conducting an inventory at the initiative of law enforcement agencies

Unscheduled (sudden) inventories are carried out unexpectedly for the materially responsible person in order to establish the presence of inventory items. They can be carried out either by decision of the head of the organization...

Inventory serves as a means of checking the organization of financial responsibility, the conditions for storing valuables, the correctness of prices, and the reliability of accounting.

The main objectives of inventory are:

Establishing the actual availability of economic resources;

Control over the safety of material assets by comparing their actual availability with accounting data;

Identification of excess and unused material assets;

Checking the condition of the warehouse and storage conditions for valuables.

Responsibility for carrying out the inventory lies with the head and chief accountant of the organization.

Inventories of material assets in the organization must be carried out within the time limits specified in the plans for control and inventory work, and approved by the manager.

Inventories must be carried out before drawing up the annual financial report, but not earlier than October 1 of the reporting year; when transferring the organization's property for rent and sale; when transforming an organization; when changing the financially responsible person; when establishing facts of theft or abuse and damage to inventory items; in case of fire or natural disasters.

At the beginning of the audit, it is necessary to check the availability of all necessary documents confirming its implementation. These include orders or instructions on conducting an inventory and the composition of the inventory commission, material reports, inventory lists or acts of inventory of valuables, matching statements, written explanations of financially responsible persons based on the results of inventories; protocols, orders and other documents for the review and approval of inventory results.

The results of inventories must be documented in inventory lists, which are compiled for each location of material assets and the financially responsible person. No blots or erasures are allowed in the inventories. Errors are corrected by crossing out incorrect entries and placing correct ones above the crossed out ones. Corrections must be agreed upon and signed by all members of the commission and financially responsible persons.

On each page of the inventory list, indicate in words the number of serial numbers of inventory items and the total total of all assets in physical terms recorded on this page, regardless of the units of measurement in which these values are taken into account. Such a calculation excludes the possibility of making any changes or additions to the inventory.

Each page of the inventory is signed by all members of the commission and the financially responsible person. At the end of the inventory, the commission records the number of serial numbers of inventory items and the total total of assets in physical indications on the last page and for the entire inventory as a whole.

On each inventory list, the financially responsible person gives a receipt with the following content: “All the valuables in this inventory list from No. to No. were checked by the commission in kind and in my presence and included in the inventory, and therefore I have no complaints against the inventory commission. The values listed in the inventory, are in my custody" (signature, date). If valuables are received during the inventory, they are included in a separate inventory under the title “Inventory assets received during the inventory”; a similar inventory is compiled when releasing inventory items (when, from whom they were received, date and number of the receipt document, name, price, quantity, amount).

During the audit at SUP "Agroservice-SSK", the listed requirements were met in the inventory lists, with the exception of the inventory list of current assets numbered 40, there is no last page with a receipt from the financially responsible person, the following content: "All valuables in this inventory list from No. to No. was checked by the commission in kind and in my presence and included in the inventory, and therefore I have no complaints against the inventory commission. The valuables listed in the inventory are in my custody "(signature, date) (Appendix F).

To identify the inventory results, the following are drawn up: comparison sheets, which are signed by all members of the commission and the financially responsible person. The comparison sheet includes only those material assets for which deviations from the accounting data were identified during the inventory. For all shortages, losses and surpluses of material assets, written explanations must be received from financially responsible persons. Based on the provided explanations and inventory materials, the commission establishes the nature and causes of identified shortages and surpluses and, in accordance with this, determines the procedure for regulating differences between inventory and accounting data, the conclusions are recorded in a protocol, which is reviewed by the permanent inventory commission and approved by the head.

The quality of the inventory is determined according to the inventory records, where the following is checked:

Availability of the name of the enterprise;

Place of inventory (warehouse, workshop, storeroom);

Time of its implementation;

Completeness of recording the names of materials, their brands, grades, articles and other distinctive features;

The procedure for correcting indicators;

Availability of signatures of members of the inventory commission on the inventory lists;

Records of responsible persons with their signature on the correctness of the inventory and acceptance of valuables for safekeeping.

If violations are identified during the formation of inventory materials, the inspector is obliged to study them and find out the reasons. These violations may be the result of the commission’s careless attitude to the performance of its duties or the result of official forgery in order to conceal established facts of shortages and surpluses of certain types of inventory items.

To check the correctness of the inventory lists, use the second copy of the inventory list, primary documents, analytical accounting data, calculations, etc.

Primary documents for capitalization and analytical accounting data are used in the case when the inventory lists contain the names of the material without indicating the grade, size, brand, number and other consumer properties, or changes are made to these indicators. The reliability of the record is established by mutual verification of the indicators of these documents with the data of the inventory list.

Quantitative accounting by grade of materials is restored according to documents if for the corresponding group of materials accounting is carried out in total terms.

The reliability of the listed balances of inventory items in the matching sheet is checked using accounting data and inventory records. To check balances according to accounting data, quantitative and assortment accounting, turnover sheets, balance sheets and other documents are used, depending on the accepted procedure for maintaining analytical accounting in accounting.

During the audit, the correctness of calculations for writing off losses within the limits of natural loss norms and in excess of these norms is checked. Write-off of losses must be carried out with the permission of the manager according to the approved norms of natural loss. In this case, the write-off of the identified shortage should not be higher than the amount of the shortage according to the matching sheet.

A separate inventory list or act indicating the period of formation (for each type of inventory), the causes of losses and their possible use by the commission records losses from damage, defects and damage. By decision of the manager, losses and shortages can be written off at the expense of the organization in the presence of acts of destruction indicating the methods and place, invoices for removal to a landfill or disposal.

The procedure for registering the write-off of losses is also checked, whether they are written off again or whether such valuables are presented during the next inventory in order to remove good-quality valuables from circulation.

When identifying shortages and surpluses of individual assets, as an exception, it is allowed to offset the shortages with surpluses resulting from re-grading for the same group of inventory assets (same name), on the same date, with the same responsible person, for one and the same period under review. Therefore, during the audit, they check compliance with the established procedure for offsetting shortages with the resulting surpluses and attributing the amount of differences to the guilty parties as a result of the fact that the value of the missing values is higher than those found in the surplus. If the specific culprits of the misgrading are not identified, then the amount differences are considered as shortages in excess of the norms of natural loss and are written off as non-operating expenses. If the misgrading did not occur through the fault of those financially responsible, then the protocols of the inventory commission should contain detailed explanations of the reasons for this misgrading.

The results of the inventory are reflected in the accounting and reporting of the month in which the inventory was completed, and for the annual inventory - in the annual report of the organization.

In conclusion, I would like to note that the audit was carried out in accordance with Decree of the President of the Republic of Belarus dated October 16, 2009 No. 510 “On improving control (supervisory) activities in the Republic of Belarus”, Instructions on the procedure for organizing and conducting audits (audits) of financial and economic activities of organizations , under the jurisdiction of the Ministry of Agriculture and Food of the Republic of Belarus, approved by Resolution of the Ministry of Agriculture and Food of the Republic of Belarus dated March 1, 2006 No. 18 "

The accounting policy of SUP "Agroservice-SSK" contains all the necessary information for the rational organization of accounting and improvement of the financial condition of the enterprise.

Internal control over the legality, reliability and timeliness of business transactions is ensured at the proper level.

A check of inventory items at SUP "Agroservice-SSK" also did not reveal any discrepancies. Inventory of current assets is carried out in accordance with the schedule, based on the results of which reports are drawn up. No discrepancies found

Thus, during the inventory of production reserves at SUP "Agroservice-SSK", a violation was identified in the preparation of the inventory list, since at the end of the inventory there are no signatures of the audit commission, as well as a receipt from the financially responsible person, the following content: "All valuables in This inventory list from No. to No. was checked by the commission in kind and in my presence and included in the inventory, and therefore I have no claims against the inventory commission. The valuables listed in the inventory are in my custody "(signature, date).

Accountants who are responsible for accounting for fuels and lubricants (fuels and lubricants) face many problems. Participants in our forum regularly discuss how to calculate standards, why they are used, and how to reflect the gasoline that was in the tank of the purchased car. The answers to these and other questions are in our article.

20.04.2012Accounting Online

Why do we need consumption standards and write-offs of fuels and lubricants?

Organizations using their own or rented cars keep records of the receipt and consumption of fuel and lubricants. There are standards that must be followed when disposing of fuel. As practice shows, accountants do not always clearly understand how to correctly apply these standards. In particular, people are confused about how to write off gasoline: according to the number of liters actually consumed or according to the standard. We will begin the answer to this question with a remark: it should be noted that the purpose of standards in accounting and tax accounting do not coincide.

Accounting

In accounting, fuel and lubricants must be written off as actual. But the difficulty is that the car does not have a device that would record the amount of gasoline in the tank. Accordingly, it is very difficult to determine “by eye” how much fuel was spent on a particular trip. Therefore, most often actual fuel consumption is calculated as the number of kilometers on the speedometer multiplied by a certain standard.

Tax accounting

The application of the standard in tax accounting is a controversial issue.

Tax authorities traditionally believe that when writing off fuel and lubricants as expenses, organizations must adhere to the limits approved by the Methodological Recommendations put into effect by Order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. Specialists from the Russian Ministry of Finance have repeatedly reminded us of this (see, for example, letters dated 09/03/10 No. 03-03-06/2/57 and letters dated 11/17/11 No. 03-11-11/288). If an organization uses a machine for which the standard has not been approved, it is necessary to develop and justify its limit (letter of the Ministry of Finance of Russia dated June 10, 2011 No. 03-03-06/4/67). In any case, it is impossible to write off fuel and lubricants in excess of the limit as expenses, officials are sure.

However, there is no such prohibition in the Tax Code. Therefore, many companies do not adhere to either their own standards or those approved by the Ministry of Transport, but reduce the tax base by the full cost of gasoline consumed. This approach is supported by judges (decision of the Supreme Arbitration Court of the Russian Federation dated August 14, 2008 No. 9586/08, resolution of the Federal Antimonopoly Service of the West Siberian District dated January 27, 2009 No. F04-7730/2008(17508-A03-46)).

There are organizations that ignore the standards of the Ministry of Transport and establish their own. They also win in court (see, for example, the resolution of the Federal Antimonopoly Service of the Volga District dated November 21, 2011 No. F06-10102/11).

Companies that have taken a “cautious” position and decided to apply a standard (approved by the Ministry of Transport or independently developed) for tax accounting purposes are allowed to apply the same standard in accounting. In other words, use the same limit value when calculating the gasoline consumed and when reducing the tax base.

How to calculate your own standard

If there is no limit approved by the Ministry of Transport for a machine, or the organization decides to use a different value, it has the right to calculate its own limit. Typically, in such a situation, companies act in one of two ways.

The first way is to borrow information about fuel consumption from the technical documentation for the car.

The second way is to create a commission and take measurements. To do this, you need to pour a certain amount of gasoline into the empty tank of the car, for example, 100 liters. Then the car should be driven until the tank is completely empty. Based on the speedometer readings, you need to determine how many kilometers it took to completely empty the tank. Finally, the number of liters must be divided by the number of kilometers. The result will be a figure showing how much gasoline the car consumes when driving one kilometer. This indicator should be recorded in the act and signed by all members of the commission.

Since fuel consumption depends on travel conditions, it is better to make control measurements “for all occasions”: separately - for a loaded and empty car, separately - for summer and winter trips, separately - for idle time with the engine running, etc. All results obtained should be reflected in a report drawn up and signed by the commission.

There is a simpler option: to approve one basic standard (for example, for the summer period) and increasing coefficients: for winter trips, for trips on congested roads, etc.

How to conduct a fuel and lubricants inventory

Since write-off according to the standard implies errors, the organization must periodically reconcile the data reflected in the accounting records and the actual balances. This reconciliation can be done once a week, a month or a quarter. Some companies do it daily.

To determine the actual balance, different methods are used. The simplest one is to pour gasoline from the tank into a measuring container and find out the volume. However, organizations rarely resort to this method.

Another method is more common. Its essence is as follows. First you need to completely fill the tank. Then you need to look in the technical documentation to determine the volume of the tank. And also look at the gas station receipt to see how much fuel was poured into the tank. If we subtract the volume of gasoline poured from the volume of the tank, we get the remainder that was in the tank before refueling. This figure must be checked with the one that appeared according to accounting data for the same date.

There are other methods - for example, using a special probe with a printed scale. However, none of the methods, except for emptying the tank, eliminates errors.

Satellite navigation systems

Nowadays, so-called satellite tracking systems (another name is satellite navigation systems) are becoming increasingly popular. They allow you to determine exactly when and how many kilometers the car has traveled and how much gasoline it has consumed. In this regard, the company that purchased such a system can write off actually consumed fuel and lubricants without using standards. The need for inventory also disappears.

To reflect in accounting the transition to the use of a satellite system for accounting for fuel and lubricants, it is necessary to issue an order that cancels the previously used fuel consumption standards. In the same document, a new method of fuel accounting is established - based on system data. It is important that the date of the order coincides with the date when the system was put into operation.

Next, you will need a printout from the system, which shows the gasoline consumption for each flight. The accountant will attach these printouts to the waybills, and based on these documents, write off the fuel and lubricants. By the way, the Russian Ministry of Finance does not object to this method (letter dated June 16, 2011 No. 03-03-06/1/354).

How to take into account the fuel received with the car

As a rule, when buying a car, the new owner receives not only the car itself, but also a certain amount of gasoline in the tank. If this is specified in the purchase and sale agreement, the accountant will be able to capitalize the fuel and lubricants without any problems.

But more often than not, fuel is not mentioned in the contract. What to do in this case? In practice, various approaches are used.

If there is not a lot of gasoline, then it is simply not taken into account, and the countdown of receipt and write-off of fuel and lubricants begins with the first refueling.

If the tank is almost full, fuel is taken into account. First, the volume is determined using the same methods as for inventory. Then they arrange either a free receipt or identification of surplus.

In the case of gratuitous receipt, the cost of fuel is recorded as the debit of account 10 and the credit of account 98 “Deferred income”. Subsequently, when writing off, entries are made to the debit of the “cost” account (20, 26 or 44) and the credit of account 10 “Materials,” as well as the debit of account 98 and the credit of account 91 “Other income and expenses.”

In tax accounting, fuels and lubricants received free of charge are taxable income (subclause 8 of Article 250 of the Tax Code of the Russian Federation).

If an organization shows surpluses identified during inventory, then in accounting they should be included in income and posted as the debit of account 10 and the credit of account 91. In tax accounting, it is also necessary to generate income on the basis of subparagraph 20 of Article 250 of the Tax Code of the Russian Federation.

How to take into account the fuel in the tank of a sold car

The opposite situation is also possible, when an organization sells a car, and with it the fuel in the tank. Here it is best to include a separate clause in the purchase and sale agreement, where the volume and price of gasoline should be indicated. This will make it possible to show the implementation of fuels and lubricants separately from the implementation of the machine. From a legal point of view, everything will be correct, because no license is required to sell fuel.

In the absence of a special clause in the agreement, the disposal of gasoline must be carried out as a debit to account 91 and a credit to account 10. Such expenses cannot be reflected in tax accounting, since the value of gratuitously transferred property does not reduce taxable income (sub. 16, Article 270 of the Tax Code of the Russian Federation).

Fuel and lubricants in the tank of a rented car

When renting out a car, the fuel tank is also fully or partially filled. Here, as in the situation with the purchase and sale, you have to figure out how to take such gasoline into account.

Sometimes organizations simply agree that the lessor transfers a certain amount of fuel, and the lessee, at the end of the lease period, undertakes to return the same amount along with the car. In this case, ownership of fuel and lubricants remains with the lessor, and the transfer of fuel is not reflected in the accounting records.

But this option is not entirely correct for the tenant, because in fact he uses the gasoline received and, as a result, must make certain entries in the accounting registers. For this reason, most companies still show the transfer of fuel and lubricants from the lessor to the lessee.

How to reflect such a transfer? The most common option is implementation. First, the lessor sells fuel to the lessee, and after the end of the contract, the lessee sells the same amount to the lessor.

Another option is a commodity loan. Here the lessor acts as a lender, and the tenant acts as a borrower. Both options are completely legal, and the accountant can only choose the one that is most convenient in a particular situation.

How to write off savings in accounting and tax accounting, what documents should I attach?

There was a surplus of fuel and lubricants for a company car. How to take into account surpluses identified during the inventory? How to reflect inventory surpluses in accounting?

Question: As a result of the annual inventory, a surplus of fuel and lubricants arose in the company car. How to write off savings in accounting and tax accounting, what documents should I attach?

Answer: If, as a result of the inventory, surpluses are identified, then draw up a matching statement. Compile it only for those assets for which there are deviations from the accounting data. In this case, indicate only the discrepancies (in this case, the surplus) identified during the inventory. Fill out the form manually or on the computer. This procedure is provided for in paragraph 4.1 by order of the Ministry of Finance of Russia dated June 13, 1995 No. 49.

You can develop matching statements yourself. Or it is easier to use the forms that are approved by paragraph 1.2 of the Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88. This conclusion follows from part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

For the cost of the surplus identified during the inventory, make the following entry:

Debit 10, Credit 91-1 (reflects the cost of surplus fuel and lubricants identified during inventory).

Include the market value of fuel and lubricants in income when calculating income tax at the time of completion of the inventory (drawing up an act of the inventory commission) or on the date of drawing up the annual financial statements (i.e. no later than December 31 of the reporting year). Do this regardless of which method of determining the tax base the organization uses - accruals or cash. This follows from paragraph 1 of Article 271 and paragraph 2 of Article 273 of the Tax Code of the Russian Federation.

The cost of surplus fuel and lubricants when used in performing work or providing services should be included as part of material costs. In this case, the cost that can be taken into account when calculating income tax is defined as the amount that was previously taken into account as part of income.

This is stated in paragraph 2 of paragraph 2 of Article 254 of the Tax Code of the Russian Federation and explained by the Ministry of Finance of Russia in letter dated December 25, 2015 No. 03-03-06/1/76196.

Rationale

How to take into account surpluses identified during an inventory

Accounting

How to reflect inventory surpluses in accounting

In accounting, reflect surpluses identified during inventory on account 91 “Other income and expenses” in correspondence with property accounting accounts.

Account for property at the market price, that is, at the value that can be obtained as a result of the sale of this property (clause , Methodological guidelines, approved, clause 29 of Methodological recommendations, approved). Information about the level of current market prices must be confirmed by documents or through an examination. This follows from paragraph 10.3 of PBU 9/99.

For the cost of the surplus identified during the inventory, make the following entry:*

Debit 01 (10, 40, 43, 50...) Credit 91-1*

– reflects the value of the surplus identified during the inventory.

This follows, in particular, from paragraph 36 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, paragraph 29 of the Methodological Instructions approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

In the accounting accounts, reflect the surplus at the time of completion of the inventory (drawing up an act of the inventory commission) or on the date of drawing up the annual financial statements (i.e. no later than December 31 of the reporting year).*

Income tax

When calculating income tax, take into account excess property identified during inventory as part of non-operating income (Clause 20, Article 250 of the Tax Code of the Russian Federation). Determine income based on the market price of the property (clause 6 of Article 274 of the Tax Code of the Russian Federation).*

Include the market value of property in income when calculating income tax at the time of completion of the inventory (drawing up an act of the inventory commission) or on the date of drawing up the annual financial statements (i.e. no later than December 31 of the reporting year). Do this regardless of which method of determining the tax base the organization uses - accruals or cash. This follows from paragraph 1 of Article 271 and Article 273 of the Tax Code of the Russian Federation.

Accounting for fuel and lubricants according to waybills - 2018-2019 (hereinafter - PL) must be properly organized in any organization. It will allow you to restore order and control the consumption of material resources. The most relevant use of PL is for accounting for gasoline and diesel fuel. Let's consider the algorithm for accounting and tax accounting of fuel and lubricants using waybills in more detail.

The concept of fuels and lubricants

Fuel and lubricants include fuel (gasoline, diesel fuel, liquefied petroleum gas, compressed natural gas), lubricants (motor, transmission and special oils, grease) and special fluids (brake and coolant).

What is a waybill

A waybill is a primary document that records the vehicle’s mileage. Based on this document, gasoline consumption can be determined.

Organizations for which the use of vehicles is the main activity must use the PL form with the details specified in Section II of Order No. 152 of the Ministry of Transport dated September 18, 2008.

Do you have any doubts about the correctness of capitalization or write-off of material assets? On our forum you can get an answer to any question that raises your doubts. For example, you can clarify what the basic fuel consumption rate is recommended by the Ministry of Transport.

Read about the latest requirements of the Ministry of Transport for mandatory details in waybills in the materials:

- “The list of mandatory details of the waybill has been expanded”;

- “From December 15, 2017, the waybill will be issued using a new form”;

- Waybills: from March 1, 2019, the procedure for issuing changes.

For organizations that use a car for production or management needs, it is possible to develop a PL taking into account the requirements of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

An example of an order for approval of a submarine can be found.

In practice, organizations often use PLs that were approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78. This resolution has PL forms depending on the type of vehicle (for example, Form 3 for a passenger car, Form 4-P for a truck) .

Mandatory details and the procedure for filling out waybills are presented .

You can find out about recent changes in the form of the waybill from our discussions in the VK group .

Waybills must be recorded in the waybill register. Accounting for waybills and fuels and lubricants is interconnected. In organizations that are not motor transport by nature of activity, PLs can be drawn up with such regularity that it is possible to confirm the validity of the expense. Thus, an organization can issue a DP once every few days or even a month. The main thing is to confirm the expenses. Such conclusions are contained, for example, in the letter of the Ministry of Finance of Russia dated 04/07/2006 No. 03-03-04/1/327, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 04/27/2009 No. A38-4082/2008-17-282-17-282.

Accounting for fuel consumption in the waybill

If we analyze the PL forms contained in Resolution No. 78, we will see that they contain special columns designed to reflect the turnover of fuel and lubricants. This indicates how much fuel is in the tank, how much has been dispensed and how much is left. Using simple calculations, the amount of fuel used is determined.

If we turn to Order No. 152 of the Ministry of Transport, then among the mandatory details of the submarine there will not be a requirement to reflect the movement of fuel. In this case, the document must contain speedometer readings at the beginning and end of the journey, which will allow determining the number of kilometers traveled by the vehicle.

When the PL is developed by the organization independently and it does not contain information on the use of fuels and lubricants, but contains only data on the number of kilometers, the standard volume of used fuels and lubricants can be calculated using the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. It contains fuel consumption standards for different brands of vehicles and formulas for calculating consumption.

Thus, on the basis of the PL, either the actual or standard write-off of fuel and lubricants is calculated. The data calculated in this way is used for reflection in accounting.

However, the use of PL to account for fuel consumption is impossible in some cases. For example, when chainsaws, walk-behind tractors, and other similar special equipment are refueled with gasoline. In these cases, a fuel and lubricants write-off act is applied.

A sample act for writing off fuel and lubricants can be viewed on our website.

Accounting for fuel and lubricants

Like all inventories, fuel and lubricants are accounted for in the accounting department at actual cost. Expenses that are included in the actual cost are indicated in section II of PBU 5/01.

Acceptance of fuel and lubricants for accounting can be carried out on the basis of gas station receipts attached to the advance report (if the driver purchased the fuel in cash) or on the basis of coupon stubs (if gasoline was purchased using coupons). If the driver purchases gasoline using a fuel card, then accounting for fuel and lubricants on fuel cards is carried out on the basis of a report from the company issuing the card. Write-off of fuel and lubricants can be carried out using the following methods (section III):

- at average cost;

- at the cost of the 1st time of acquisition of inventory (FIFO).

PBU 5/01 has another write-off method - at the cost of each unit. But in practice, it is not applicable for writing off fuel and lubricants.

The most common way to write off fuel and lubricants is at average cost, when the cost of the remaining material is added to the cost of its receipt and divided by the total amount of the remainder and receipt in kind.

Write-off of fuel and lubricants using waybills (accounting)

To account for fuel and lubricants, the enterprise uses account 10, a separate subaccount (in the chart of accounts - 10-3). The debit of this account is used for the receipt of fuel and lubricants, and the credit for the write-off.

How is fuel and lubricants written off? Using the algorithms described above, the used amount of fuel and lubricants is calculated (actual or standard). This quantity is multiplied by the cost of the unit, and the resulting amount is written off by posting: Dt 20, 23, 25, 26, 44 Kt 10-3.

Write-off of gasoline using waybills (tax accounting)

If everything is quite simple with the write-off of fuel and lubricants in accounting, then the recognition of these expenses in tax accounting raises questions.

1st question: in what expenses should fuel and lubricants be taken into account? There are 2 options here: material or other expenses. According to sub. 5 p. 1 art. 254 of the Tax Code of the Russian Federation, fuels and lubricants are included in material costs if they are used for technological needs. Fuel and lubricants are included in other expenses if they are used to maintain official vehicles (subclause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

IMPORTANT! If the main activity of an organization is related to the transportation of goods or people, then fuel and lubricants are material costs. If vehicles are used as service vehicles, then fuel and lubricants are other expenses.

The second question: should we normalize the costs of writing off fuel and lubricants within the framework of tax accounting? The answer to this can be found by linking the details of the waybill and legislative norms:

- The PL calculates the actual use of fuel and lubricants. The Tax Code of the Russian Federation does not contain direct indications that expenses for fuel and lubricants should be taken into tax accounting only according to actual standards.

- The PL contains information only about the actual mileage. However, fuels and lubricants can be calculated according to order No. AM-23-r, paragraph 3 of which states that the standards established by it are also intended for tax calculations. The Ministry of Finance of Russia in its letters (for example, dated 06/03/2013 No. 03-03-06/1/20097) confirms that Order No. AM-23-r can be used to establish the validity of costs and determine the costs of fuel and lubricants in tax accounting according to the standards multiplied by mileage.

IMPORTANT! In tax fuel and lubricants accounting can be taken both according to actual use and according to the quantity calculated based on the standards.

In practice, a situation is possible when an organization uses transport for which fuel consumption standards are not approved in Order No. AM-23-r. But in paragraph 6 of this document there is an explanation that an organization or individual entrepreneur can individually (with the help of scientific organizations) develop and approve the necessary standards.

The position of the Ministry of Finance of Russia (see, for example, letter dated June 22, 2010 No. 03-03-06/4/61) is that before developing standards for the write-off of fuel and lubricants in a scientific organization, a legal entity or individual entrepreneur can be guided by technical documentation.

There are no explanations in the Tax Code of the Russian Federation on how to act in such a situation. In cases where an organization independently established standards for writing off fuel and lubricants and, having exceeded them, took into account the amount of excess fuel use in tax accounting, the tax inspectorate may not recognize this as an expense. Accordingly, additional income tax may be charged. In this case, the court may well support the position of the inspectorate (see, for example, the resolution of the Administrative Court of the North Caucasus District dated September 25, 2015 in case No. A53-24671/2014).

Read about the amount of fines for not having a waybill here. article .

An example of writing off fuel and lubricants using waybills

One of the most common types of fuel and lubricants is gasoline. Let's consider the example of purchasing and writing off gasoline.

Pervy LLC (located in the Moscow region) purchased 100 liters of gasoline in September 2018 at a price of 38 rubles. without VAT.

At the same time, at the beginning of the month, the LLC had a stock of gasoline of the same brand in the amount of 50 liters at an average cost of 44 rubles.

Gasoline in the amount of 30 liters was used to refuel a VAZ-11183 Kalina car. The organization uses a car for official transportation of management personnel.

The organization uses average cost estimates for materials.

Accounting for fuel and lubricantson admission

|

Amount, rub. |

Operation (document) |

||

|

Gasoline received credit (TORG-12) |

|||

|

VAT reflected (invoice) |

We calculate the average write-off cost for September: (50 l × 44 rubles + 100 l × 38 rubles) / (50 l + 100 l) = 40 rubles.

Option 1.Accounting for fuel and lubricantswhen written off in fact

The following marks are made in the submarine: fuel in the tank at the beginning of the voyage - 10 liters, issued - 30 liters, remaining after the voyage - 20 liters.

We calculate the actual use: 10 + 30 - 20 = 20 liters.

Amount to be written off: 20 l × 40 rub. = 800 rub.

Option 2.Accounting for fuel and lubricantswhen written off according to standards

Mileage marks are made in the submarine: at the beginning of the voyage - 2,500 km, at the end - 2,550 km. This means that 50 km have been covered.

In paragraph 7 of Section II of Order No. AM-23-r there is a formula for calculating gasoline consumption:

Qn = 0.01 × Hs × S × (1 + 0.01 × D),

where: Q n - standard fuel consumption, l;

Hs - basic fuel consumption rate (l/100 km);

S—vehicle mileage, km;

D is the correction factor (its values are given in Appendix 2 to Order No. AM-23-r).

According to the table in sub. 7.1 by car make we find Hs. It is equal to 8 liters.

According to Appendix 2, coefficient D = 10% (for the Moscow region).

We calculate gasoline consumption: 0.01 × 8 × 50 × (1 + 0.01 × 10) = 4.4 l

Amount to be written off: 4.4 l × 40 rub. = 176 rub.

Since the car is used as a company car, the cost of accounting for fuel and lubricants in the tax accounting of fuel and lubricants will be recognized as other expenses. The amount of expenses will be equal to the amounts recorded in the accounting records.

Results

Fuel and lubricants are a significant expense item in many organizations. This means that accountants need to be able to keep records of fuel and lubricants and justify these expenses. Using waybills is one way to determine the amount of fuel and lubricants used.

With the help of PL, you can not only confirm the production necessity of expenses, but also record the distance traveled by a car or other vehicle, as well as determine indicators for calculating the volume of used fuels and lubricants.

After determining the actual or standard volume of use, the amount to be written off can be calculated by multiplying the unit cost by the volume.

Accounting for fuels and lubricants written off as a result of the operation of special equipment that does not have an odometer can be carried out on the basis of a fuel and lubricants write-off act.

Particular attention should be paid to recognizing expenses for fuel and lubricants within the framework of tax accounting.